Wir halten Sie auf dem Laufenden

- EOS Konzern erzielt zweitstärkstes Ergebnis in 50-jähriger Geschichte

- ESG Risk Rating von Morningstar Sustainalytics: EOS Gruppe gehört zu den Top 3 in der Branche „Consumer Finance“

- Corporate Responsibility (CR): EOS veröffentlicht zweiten kombinierten Jahres- und Nachhaltigkeitsbericht

Der EOS Konzern erzielt mit 412,9 Millionen Euro im Geschäftsjahr 2023/24 sein zweitstärkstes Ergebnis (EBITDA) in der 50-jährigen Unternehmensgeschichte und kann sich mit einem Umsatzplus von 2,1 Prozent (insgesamt 997,3 Millionen Euro) auf einem sehr guten Niveau halten. Gleichzeitig lag das Investitionsvolumen mit rund 583,5 Millionen Euro deutlich unter dem Ausnahmejahr 2022/23. Massgeblich zum insgesamt positiven Ergebnis beigetragen hat die erfolgreiche Bearbeitung der in den Vorjahren angekauften Forderungsportfolios.

Erfolgreiche Performance trotz herausfordernder Wirtschaftslage

Trotz der gesamtwirtschaftlichen Herausforderungen wie steigender Zinsen und hoher Inflation konnte der EOS Konzern im vergangenen Geschäftsjahr erneut ein beeindruckendes EBITDA von über 400 Millionen Euro erzielen, so Marwin Ramcke, CEO der EOS Gruppe. "Die unsicheren makroökonomischen Zeiten werden bleiben. Aber wir haben den professionellen Umgang mit Unsicherheit zu unserer Stärke gemacht, können resilient und flexibel agieren und uns auf die besten Lösungen für unsere Kund*innen konzentrieren“, sagt Ramcke weiter.

Dass die EOS Gruppe trotz der makroökonomisch schwierigen Situation ein erneut sehr gutes Ergebnis erzielt hat, liege insbesondere an der herausragenden Performance der internationalen Teams in den vergangenen Jahren, betont der zum Zeitpunkt des Geschäftsjahresabschlusses verantwortliche CFO der EOS Gruppe, Justus Hecking-Veltman. Insgesamt seien die Investitionen im Vergleich zum Ausnahmejahr 2022/23 zwar deutlich gesunken, signifikante Forderungskäufe in zwei- oder dreistelliger Millionenhöhe konnten die starke Marktposition jedoch bestätigen, so Hecking-Veltman weiter. „Der Kauf von Forderungspaketen wird daher auch künftig im Fokus der EOS Gruppe bleiben.“

Zum 1. August 2024 hat Hecking-Veltman das Unternehmen verlassen, um sich anderen Herausforderungen zu stellen. Seine Nachfolgerin wird die promovierte Wirtschaftswissenschaftlerin Dr. Eva Griewel.

Osteuropa übertrifft Umsatzniveau des Vorjahres leicht

Mit einem Anteil von 41,9 Prozent am Gesamtumsatz bleibt Osteuropa die umsatzstärkste Region im EOS Konzern. Signifikante Umsatzsteigerungen konnten insbesondere die Gesellschaften in Bosnien u. Herzegowina, Bulgarien, Griechenland und Polen erzielen. Trotz Zinserhöhungen wurden Investitionen im Wert von 212,5 Millionen Euro getätigt. „Dies ist allen Kolleg*innen zu verdanken, die ihre Komfortzone verlassen haben und neue Wege gegangen sind“, so Carsten Tidow, der in der Geschäftsführung die Region Osteuropa verantwortet.

Westeuropa zieht mit Umsatzplus von 6,9 Prozent am deutlichsten an

Mit 323,4 Millionen Euro (32,4 Prozent des Gesamtumsatzes) stieg der Umsatz der Region Westeuropa im Vergleich zu den anderen Regionen der EOS Gruppe am deutlichsten (insgesamt 6,9 Prozent). Für die positive Entwicklung sei vor allem die erfolgreiche Bearbeitung bestehender Forderungsportfolios verantwortlich, so Sebastian Pollmer, der seit Beginn des Geschäftsjahres 2024/25 die Region Westeuropa verantwortet. Besonders hervorzuheben sei die Gesellschaft in Frankreich, die eine starke finanzielle Leistung gezeigt habe. Zusammen mit einem Co-Investor hatte EOS Frankreich den Ankauf eines Rekordportfolios mit einem Nennwert von 364 Millionen Euro getätigt. Auch die Gesellschaften in Dänemark und Portugal, das nach nur zwei Jahren bereits auf dem Markt etabliert ist, haben einen wertvollen Beitrag zum Anstieg des Umsatzes geleistet, so Pollmer weiter.

Deutschland auf Vorjahresniveau

Auf dem deutschen Markt verzeichnete der EOS Konzern mit einem Umsatzanteil von 25,5 Prozent keine Veränderungen zum Vorjahr. Die Wettbewerbssituation bleibt hier herausfordernd. Umstrukturierungsmassnahmen, wie die neugegründete Region Zentraleuropa, der Deutschland seit Beginn des Geschäftsjahres 2024/25 angehört, „beginnen Früchte zu tragen“, so Stephan Ohlmeyer, der seit März 2024 verantwortlich für die neue Region ist.

Nachhaltigkeit weiter im Fokus

Auch über die Geschäftszahlen hinaus konnte sich die EOS Gruppe im vergangenen Geschäftsjahr behaupten. Aus dem Stand hat der internationale Konzern 2023 ein herausragendes ESG Risk Rating erhalten. „EOS gehört laut der renommierten Ratingagentur Morningstar Sustainalytics zu den Top 3 aller bewerteten Unternehmen unserer Branche ,Consumer Finance’“, so Marwin Ramcke. „Auf diese Bewertung bin ich sehr stolz. Eine Spitzenposition auf Anhieb zu erreichen beweist, dass unsere Corporate Responsibility Strategie erfolgreich ist.“

Mit einem an den Standards der Global Reporting Initiative (GRI) orientierten Jahres- und Nachhaltigkeitsbericht macht EOS transparent, was die Gruppe in diesem Bereich leistet. Um die Gehälter von Männern und Frauen vergleichen zu können, wurde zum Beispiel erstmals eine Gender Pay Gap Analyse initiiert. Ausserdem hat das Unternehmen den eigenen CO2-Fussabdruck (Scope 1 & 2) ermittelt. „Diese Initiativen werden wir auch in diesem Geschäftsjahr weiter vorantreiben und daraus zielgerichtete Massnahmen ableiten – etwa zur Reduktion von Emissionen “, betont Ramcke.

Die Corporate Responsibility Strategie ist darüber hinaus fest im Kerngeschäft der EOS Gruppe verankert. Verantwortungsvolles Inkasso und eine nachhaltige Entschuldung säumiger Verbraucher*innen sind für EOS zentral. So hat die Gruppe im letzten Geschäftsjahr mehr als fünf Millionen Schuldenfälle erfolgreich abgeschlossen, damit säumigen Verbraucher*innen geholfen und rund 1,9 Milliarden Euro in den Wirtschaftskreislauf zurückgeführt.

Über die EOS Gruppe

Die EOS Gruppe ist ein führender technologiebasierter Investor in Forderungsportfolios und Experte bei der Bearbeitung offener Forderungen. Mit mehr als 50 Jahren Erfahrung und Standorten in über 20 Ländern bietet EOS weltweit smarte Services rund ums Forderungsmanagement. Im Fokus stehen Banken sowie Unternehmen aus den Bereichen Immobilien, Telekommunikation, Energieversorgung und E-Commerce. EOS beschäftigt mehr als 6.000 Mitarbeiter*innen und gehört zur Otto Group.

Weitere Informationen zur EOS Gruppe: https://eos-solutions.com/

Hamburg, 26. Juli 2023

- Signifikante Steigerung des Investitionsvolumens in Ost- und Westeuropa

- Internationale Kollaboration und Digitalisierung rücken noch stärker in den Fokus

- Corporate Responsibility (CR): Kombinierter Jahres- und Nachhaltigkeitsbericht orientiert sich erstmals an der Global Reporting Initiative (GRI)

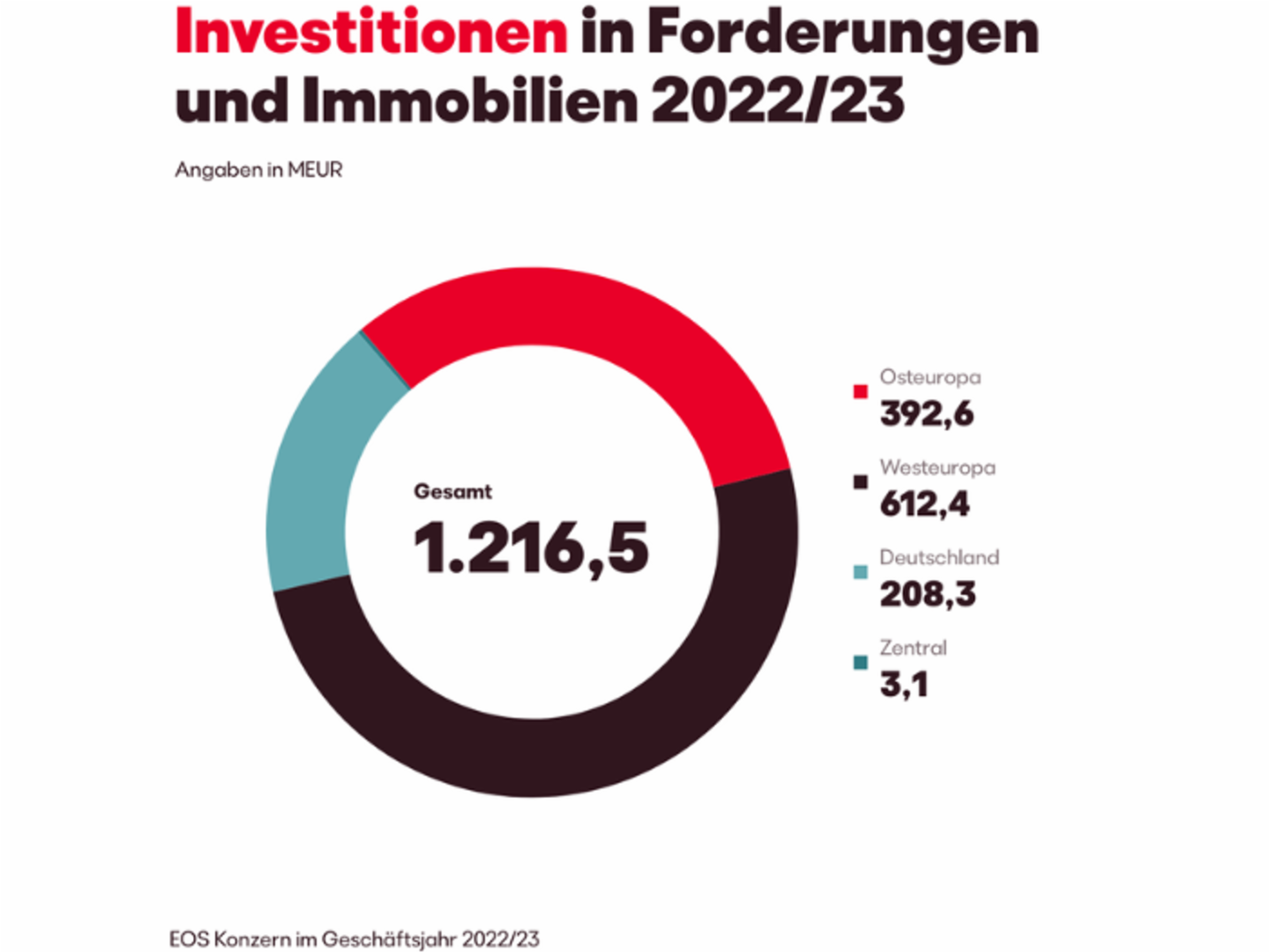

Die EOS Gruppe ist im Geschäftsjahr 2022/23 stark gewachsen. Der führende Investor in Non-Performing Loans, Forderungs- sowie Immobilienportfolios in Europa und Experte in der Bearbeitung offener Forderungen erzielte im Geschäftsjahr 2022/23 ein EBITDA von 445,9 Millionen Euro. Massgeblich zum Erfolg beigetragen hat der signifikante Anstieg des Investitionsvolumens von 668,6 Millionen Euro (im Vorjahr) auf 1,2 Milliarden Euro. EOS hat dabei sowohl in besicherte als auch unbesicherte Forderungspakete investiert.

Herausragende operative Performance

Die hervorragende Bearbeitung bestehender NPL-Portfolios (Non-Performing Loans) aus vergangenen Jahren trug ebenfalls zum Ergebnis- und Umsatzplus im Geschäftsjahr 2022/23 bei. Dazu Marwin Ramcke, CEO der EOS Gruppe: „Absehbar war solch ein Wachstum angesichts der internationalen politischen und makroökonomischen Lage zu Beginn des Geschäftsjahres nicht. Dass wir in diesen unruhigen Zeiten solch ein Ergebnis erzielen, ist insbesondere auf den Einsatz unserer etwa 6.000 Mitarbeitenden zurückzuführen.”

Die breite Aufstellung der EOS Gruppe mit 24 Landesgesellschaften in Europa habe ebenfalls positiv auf das Gesamtergebnis gewirkt, so der CFO der EOS Gruppe, Justus Hecking-Veltman. „Unsere Diversifizierung verleiht uns als Gruppe enorme Stabilität. Wir sind nicht von einzelnen Märkten abhängig. Unsere langjährige Expertise als Käufer von NPL-Portfolios, aber auch unsere Geduld in einigen Märkten haben sich in diesem Geschäftsjahr ausgezahlt“, so Hecking-Veltman.

Osteuropa knüpft mit hohem Investitionsniveau an Vorjahr an

Mit einem Anteil von 42 Prozent bleibt Osteuropa die umsatzstärkste Region im EOS Konzern. Im Vorjahresvergleich konnten die osteuropäischen Landesgesellschaften ihren Umsatz sogar um knapp 50 Prozent steigern. „Mit knapp 400 Millionen Euro Investitionsvolumen konnten wir zudem an unseren hohen Wert aus dem Jahr zuvor anknüpfen“, sagt Carsten Tidow, der als Teil der Geschäftsführung die Region Osteuropa verantwortet. Beispielhaft dafür stünden neben erneut hohen Investitionen in Griechenland, Polen und Kroatien auch ein kleines Land wie Bosnien und Herzegowina, wo das Geschäft in besicherte NPL-Portfolios stark ausgebaut wurde.

Westeuropa vervierfacht Investitionsvolumen

Mit 612 Millionen Euro gelang es dem EOS Konzern in Westeuropa das Investitionsvolumen mehr als zu vervierfachen. Dies sei vor allem auf die Märkte in Frankreich und Spanien zurückzuführen, sagt Dr. Andreas Witzig, Mitglied der Geschäftsführung und verantwortlich für die Region Westeuropa. Besonders erwähnenswert sei auch Portugal in diesem Zusammenhang: „Unsere dortige Landesgesellschaft haben wir erst 2022 gegründet. Dennoch sind schon heute mehr als 20 Mitarbeitende im portugiesischen NPL-Markt aktiv und konnten erste NPL-Käufe abschliessen.“ Anteil an dem guten Start habe auch die Implementierung des gruppeneigenen Inkassosystems Kollecto+ gehabt, das bereits in acht EOS Ländern im Einsatz ist und relevante Synergien schaffe.

Hoher Wettbewerbsdruck in Deutschland

Auf dem deutschen Markt verzeichnete der EOS Konzern einen Umsatzrückgang. Hauptursache hierfür sei der hohe Wettbewerbsdruck, so Andreas Kropp, EOS Deutschland Geschäftsführer. „Der deutsche NPL-Markt ist der etablierteste von allen NPL-Märkten, in denen wir als Konzern aktiv sind. Es gibt viele Wettbewerber, die für ein hohes Preisniveau bei den Portfolios sorgen. Die Anbindung an unser gruppeneigenes Inkassosystem Kollecto+ ist für uns ein wichtiger Schritt, um effizienter zu agieren und die Wettbewerbsfähigkeit zu steigern”, so Kropp weiter.

„Inkasso bedeutet Verantwortung zu übernehmen“

Erstmalig veröffentlicht die EOS Gruppe einen kombinierten Jahres- und Nachhaltigkeitsbericht. Dieser orientiert sich an den Standards der Global Reporting Initiative (GRI) und zeigt, wie EOS die Nachhaltigkeitsziele der Vereinten Nationen unterstützt.

„Wir haben immer gesagt, Inkasso bedeutet Verantwortung zu übernehmen. Corporate Responsibility ist deshalb schon lange ein grosses Thema für uns“, betont CEO Marwin Ramcke. „Wir wollen jeden Tag etwas besser werden. Die GRI-Standards helfen uns dabei, transparent zu machen, wie nachhaltig unser Handeln ist und was wir in diesem Bereich leisten.“ Neben klassischen Umweltthemen spiele laut Andreas Kropp auch der faire Umgang mit säumigen Verbraucher*innen eine grosse Rolle. „Wir wollen sie dabei unterstützen, möglichst schnell schuldenfrei zu werden. Dafür bieten wir verschiedene Services an, die die Zahlung zum Beispiel anonym und jederzeit ermöglichen. Im deutschen Serviceportal können Verbraucher*innen zudem ihre Rate selbst festlegen.“

Über die EOS Gruppe

Die EOS Gruppe ist ein führender technologiebasierter Investor in Forderungsportfolios und Experte bei der Bearbeitung offener Forderungen. Mit fast 50 Jahren Erfahrung und Standorten in 24 Ländern bietet EOS weltweit smarte Services rund ums Forderungsmanagement. Im Fokus stehen Banken sowie Unternehmen aus den Bereichen Immobilien, Telekommunikation, Energieversorgung und E-Commerce. EOS beschäftigt mehr als 6.000 Mitarbeiter*innen und gehört zur Otto Group.

Weitere Informationen zur EOS Gruppe: eos-solutions.com

Hamburg, 15. März 2023

- Inflation und Energiekosten Hauptgründe für neue Schulden

- Verbraucher*innen sparen vor allem bei Reisen, Restaurantbesuchen und neuer Kleidung

- Großteil der Europäer*innen sorgt sich um ihre finanzielle Zukunft

Die sprunghaft angestiegenen Inflationsraten sowie die Energiekrise führen bei der Mehrheit der Europäer*innen (53 Prozent) zu einem gesteigerten Preisbewusstsein. Gleichzeitig nahm etwa ein Fünftel in den vergangenen sechs Monaten neue Schulden auf. Das ergab die aktuelle repräsentative „Europeans in financial trouble?“ EOS Consumer Study 2023, für die 7.700 Verbraucher*innen in 13 europäischen Ländern befragt wurden.

Verbraucher*innen in Osteuropa im Schnitt stärker von neuen Schulden betroffen

Besonders in osteuropäischen Ländern wie Rumänien (67 Prozent), Ungarn (66 Prozent) und Tschechien (63 Prozent) haben Konsument*innen in den letzten sechs Monaten gezielt auf ihre Ausgaben geachtet. Mit Blick auf Gesamteuropa gaben die Befragten an, insbesondere bei Reisen sowie Kultur- und Freizeitaktivitäten (jeweils 33 Prozent), aber auch bei neuer Kleidung (28 Prozent) zu sparen. Gleichzeitig nahm etwa jede*r Fünfte in den letzten sechs Monaten neue Schulden auf. Hauptgründe hierfür waren vor allem die Inflation (49 Prozent) und die gestiegenen Energiekosten (27 Prozent).

In osteuropäischen Ländern wie Rumänien und Ungarn (jeweils 30 Prozent) sowie Nordmazedonien (29 Prozent) und Serbien (28 Prozent) wurden dabei öfter neue Schulden als im europäischen Durchschnitt aufgenommen. Westeuropäer*innen nutzten die Neuschulden häufiger (18 Prozent) für Reisen, im Gegensatz zu Osteuropäer*innen, die Schulden vor allem für Heizen und Strom aufnahmen (28 Prozent).

„Schulden sind nicht nur in Krisenzeiten unangenehm. Wenn es um das Heizen und Strom geht, drücken sie sogar einen existenziellen Liquiditätsengpass aus. Umso wichtiger ist es, diesen Menschen mit Empathie und Respekt zu begegnen und auf sie zugeschnittene Lösungen zu erarbeiten, beispielsweise in gemeinsamen Vereinbarungen für Raten und die Höhe von Einmalzahlungen“, sagt Bartosz Jurczyk, Operations and Strategy Division Director bei EOS in Polen. Das Ziel von EOS sei es immer, Menschen zu einer für sie passenden und schnellen Lösung beim Abbau ihrer Schulden zu verhelfen, so Jurczyk weiter.

Bei der Suche nach maßgeschneiderten Lösungen für säumige Verbraucher*innen werden analytische Daten- und Entscheidungsmodelle hinzugezogen, mit denen genau bestimmt werden kann, welche Kommunikationskanäle und Zahlungsmethoden Verbraucher*innen individuell präferieren. „Das bedeutet, dass Inkassoaktivitäten bereits innerhalb unserer Systeme auf die jeweilige Person zugeschnitten werden”, erklärt Mirjana Ćevriz, Business-Analystin und Application-Support-Expertin bei EOS in Serbien.

Inflation größte Zukunftssorge

Die hohe Inflation und die sprunghaft angestiegenen Energiekosten führen bei knapp Dreiviertel der befragten Verbraucher*innen (73 Prozent) zu finanziellen Zukunftsängsten. Die Sorge um Arbeitslosigkeit treibt insbesondere die 18- bis 34-Jährigen um. „Die Studie zeigt, dass die Inflation nicht spurlos an den Verbraucher*innen vorbeigeht“, so Marwin Ramcke, CEO der EOS Gruppe. „Besonders in Krisenzeiten lassen sich Schulden oft nicht vermeiden. Sie können kurzfristige Engpässe überbrücken und sogar Existenzen retten. Als eines der führenden Inkassounternehmen in Europa ist es uns wichtig, Verbraucher*innen fair bei der Rückzahlung ihrer Schulden zu unterstützen.“ Dies helfe ihnen persönlich, genauso aber auch der Wirtschaft, in die Geld zurückgeführt werde, so Ramcke weiter.

Bargeld besonders beliebt

Neben dem verantwortungsvolleren Umgang mit höheren Preisen, zeigt die Studie ebenfalls eine Veränderung bei der Nutzung von Zahlungsmethoden. 42 Prozent gaben an, in den letzten sechs Monaten häufiger Bargeld genutzt zu haben, als vorher. Vor allem bei den 18- bis 34-Jährigen, von denen knapp die Hälfte öfter zu Bargeld gegriffen hat, fällt das Ergebnis besonders überraschend aus. Gleichzeitig ergab die Studie aber auch, dass Menschen in dieser Altersgruppe diversere Zahlungsmethoden nutzen.

Zur EOS Studie “Europeans in financial trouble?”

Gemeinsam mit Dynata, die auf Onlinebefragungen spezialisiert sind, befragte EOS zwischen dem 3. und 9. Februar 2023 7.700 Verbraucher*innen in 13 europäischen Ländern per Onlinefragebogen. Der Fokus lag auf der Frage, wie die letzten sechs Monate das eigene Konsumentenverhalten sowie die eigene finanzielle Situation beeinflusst haben.

Über die EOS Gruppe

Die EOS Gruppe ist ein führender technologiebasierter Investor in Forderungsportfolios und Experte bei der Bearbeitung offener Forderungen. Mit über 45 Jahren Erfahrung und Standorten in 24 Ländern bietet EOS seinen rund 20.000 Kund*innen weltweit smarte Services rund ums Forderungsmanagement. Im Fokus stehen Banken sowie Unternehmen aus den Bereichen Immobilien, Telekommunikation, Energieversorgung und E-Commerce. EOS beschäftigt mehr als 6.000 Mitarbeiter*innen und gehört zur Otto Group.

Weitere Informationen zur EOS Gruppe: www.eos-solutions.com

Kloten, 5. Oktober 2022

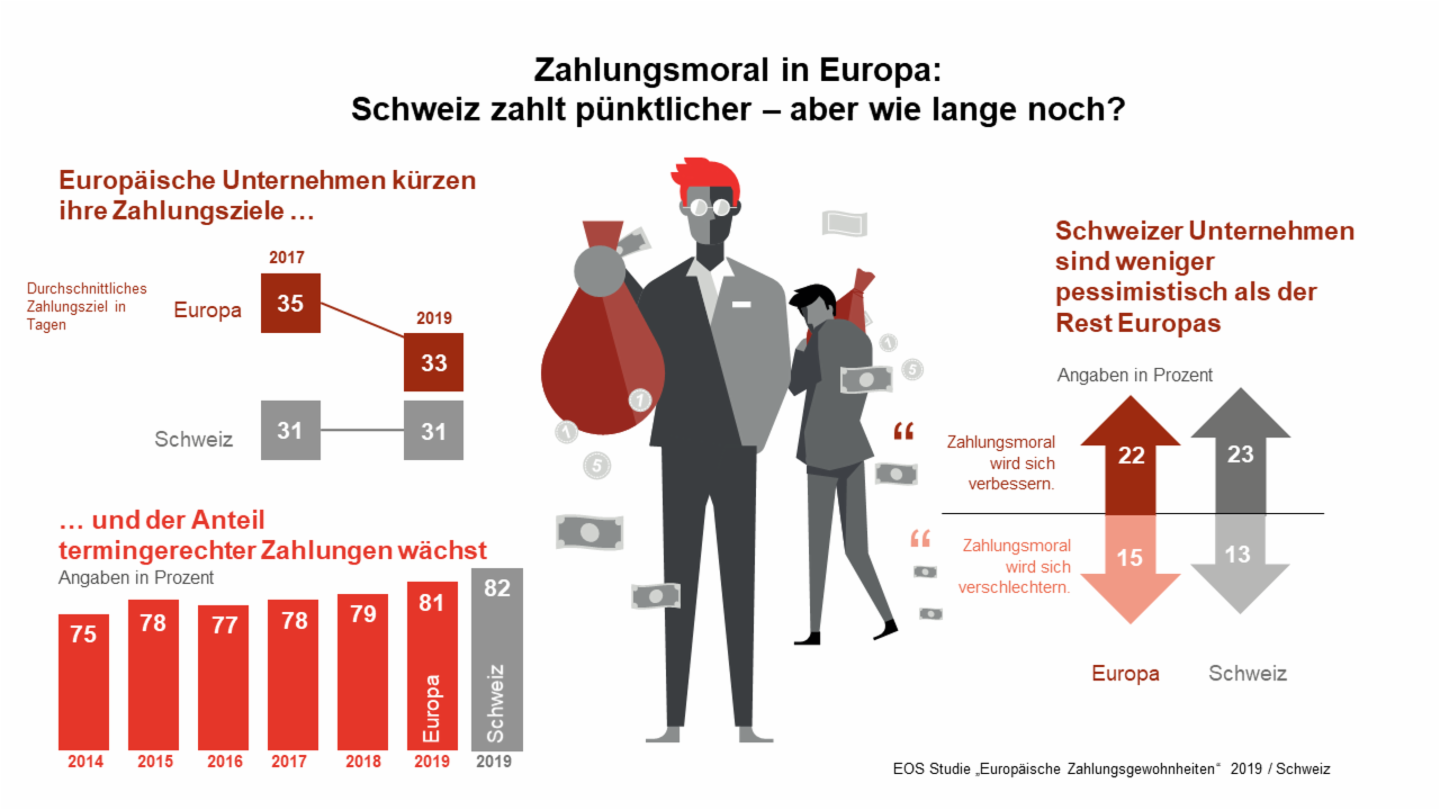

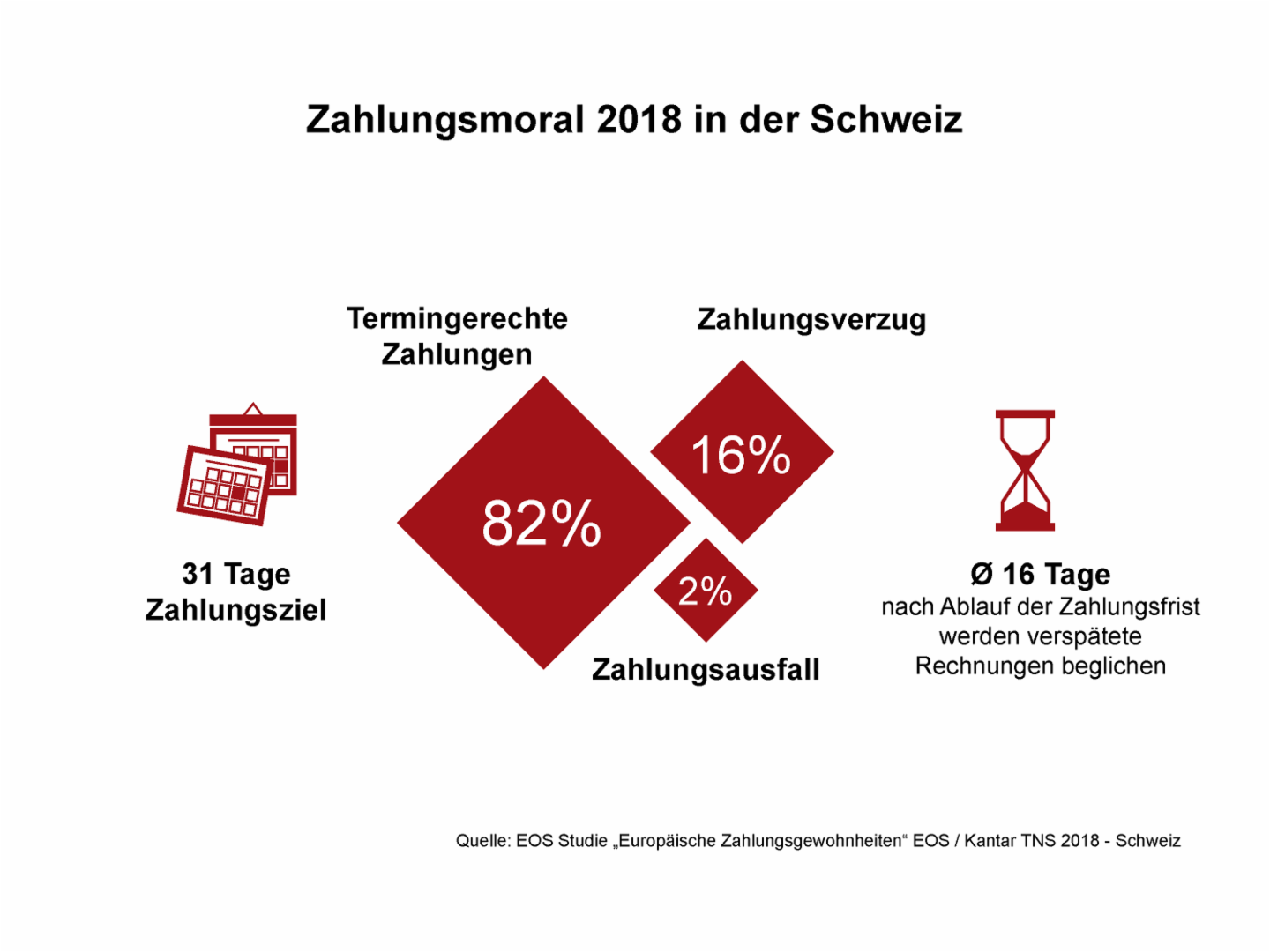

- Fast jedes 4. Unternehmen rechnet mit einer Verschlechterung des Zahlungsverhaltens

- In Westeuropa wird jede 5. Rechnung zu spät gezahlt, in Osteuropa sogar jede 4

Die Zahlungsmoral in Europa hat sich in den letzten drei Jahren ¬verschlechtert. Bei etwa jedem 5. Unternehmen führt diese Entwicklung zu Existenzängsten. Das ergab die mittlerweile 13. repräsentative EOS Studie „Europäische Zahlungsgewohnheiten“, für die 3.200 Unternehmen in 16 europäischen Ländern befragt wurden.

Trotz verlängerter Zahlungsfristen durch die Unternehmen, haben vor allem Privatkund*innen ihre Rechnungen im Schnitt 19 Tage zu spät beglichen. Im Vergleich zur Vorgängerstudie von 2019, wo 16 Prozent der Rechnungen von Privatkund*innen verspätet oder gar nicht gezahlt wurden, sind es in der aktuellen Studie bereits 20 Prozent. Als Hauptgrund für das schlechte Zahlungsverhalten nannten die befragten Unternehmen Liquiditätsengpässe ihrer Kund*innen.

Als Folge dieser Zahlungsverzögerungen und -engpässe gaben die Unternehmen an, am häufigsten selbst mit Liquiditätsengpässen (42 Prozent) sowie Gewinneinbussen (51 Prozent) zu kämpfen. Zur Kompensation mussten knapp ein Drittel der Unternehmen ihre Investitionen reduzieren und Preise erhöhen. Entsprechend pessimistisch blicken die Unternehmen in die Zukunft. Während 2019 noch 22 Prozent der Befragten von einer Verbesserung der Zahlungsmoral ausgingen, rechnen aktuell knapp 24 Prozent der Befragten mit einer weiteren Verschlechterung. Vor allem in Dänemark, der Schweiz, der Slowakei, Tschechien, Slowenien und Bulgarien sind die Prognosen im Vergleich zu 2019 besonders gedämpft ausgefallen. „Dass sich die Zahlungsmoral deutlich verschlechtert hat, ist beunruhigend – gerade, weil wir angesichts aktueller Wirtschaftszahlen und der hohen Inflation mit einem weiteren Rückgang des Zahlungsniveaus rechnen müssen“, sagt Marwin Ramcke, CEO der EOS Gruppe.

Professionalisierung im Forderungsmanagement

Um Forderungen beizutreiben, arbeiten immer mehr Unternehmen mit externen Dienstleistern im Forderungsmanagement zusammen. „Liquiditätsmangel ist eine der häufigsten Ursachen für Insolvenzen und den Verlust von Arbeitsplätzen.“ Europäische Unternehmen sollten daher ihr Forderungsmanagement weiter professionalisieren und die Zusammenarbeit mit externen Partnern prüfen, empfiehlt Ramcke.

Besonders Osteuropa liegt bei der Professionalisierung des Forderungsmanagements vorne. Etwa die Hälfte der Unternehmen setzt hier bereits auf die Unterstützung externer Spezialisten. „Gerade angesichts schwieriger Wirtschaftszahlen gilt: Inkassounternehmen sind für Unternehmen und den Wirtschaftskreislauf eine wichtige Stütze, weil sie Liquidität zurückführen“, betont Christina Schulz, verantwortlich für das Division Management Osteuropa bei EOS.

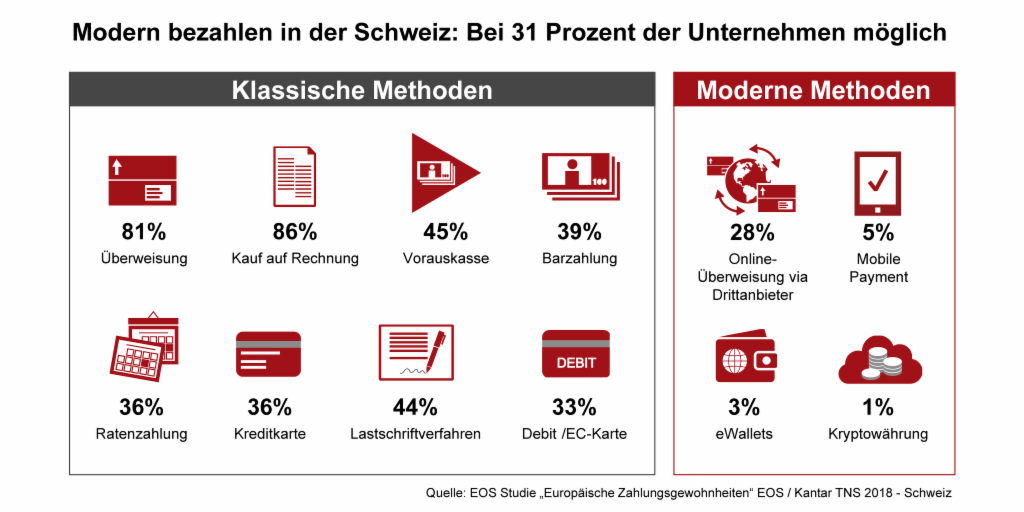

Ausbau digitaler Zahlungsmethoden

Zugleich wird der Ausbau digitaler Zahlungsmethoden immer relevanter für Unternehmen. Dieser ist sowohl in West- als auch Osteuropa seit 2019 deutlich gestiegen. Dabei haben osteuropäische Unternehmen mit einer Steigerung um 20 Prozentpunkte das Angebot digitaler Zahlungsmethoden fast verdoppelt. Auch die Zahlungsmethode Buy Now, Pay Later (BNPL) rückt in den Fokus: Vier von zehn europäischen Unternehmen sehen diese Zahlungsmethode als neue Kreditkarte und ein Muss im Zahlungsangebot.

Zur EOS Studie „Europäische Zahlungsgewohnheiten“

Gemeinsam mit dem unabhängigen Marktforschungsinstitut Kantar befragte EOS zwischen dem 4. März und 19. April 2022 3.200 Unternehmen in 16 europäischen Ländern via Telefoninterviews zu den hiesigen Zahlungsgewohnheiten. Jeweils 200 Unternehmen (mit je mehr als fünf Millionen Euro Jahresumsatz) aus Belgien, Bulgarien, Dänemark, Deutschland, Frankreich, Griechenland, Grossbritannien, Kroatien, Polen, Rumänien, Schweiz, Slowakei, Slowenien, Spanien, Tschechien und Ungarn beantworteten im Frühjahr 2022 Fragen zu eigenen Zahlungserfahrungen sowie zu aktuellen Themen im Risiko- und Forderungsmanagement. Die Studie wurde von EOS bereits zum 13. Mal durchgeführt.

Über die EOS Gruppe

Die EOS Gruppe ist ein führender technologiebasierter Investor in Forderungsportfolios und Experte bei der Bearbeitung offener Forderungen. Mit über 45 Jahren Erfahrung und Standorten in 25 Ländern bietet EOS seinen rund 20.000 Kund*innen weltweit smarte Services rund ums Forderungsmanagement. Im Fokus stehen Banken sowie Unternehmen aus den Bereichen Immobilien, Telekommunikation, Energieversorgung und E-Commerce. EOS beschäftigt mehr als 6.000 Mitarbeiter*innen und gehört zur Otto Group.

Weitere Informationen zur EOS Gruppe: eos-solutions.com

- Grosse Fortschritte hin zu einer voll durchdigitalisierten Unternehmensgruppe

- Rekordjahr im Bereich des Forderungskaufs mit insgesamt 669 Millionen Euro an Investitionen in NPL und Immobilien

Hamburg / Kloten, 20. Juli 2022 – Die EOS Gruppe, internationaler Finanzinvestor und technologiebasierter Inkassodienstleister mit Hauptsitz in Hamburg, hat sich im Geschäftsjahr 2021/22 gut und stabil entwickelt. Trotz der Corona-Pandemie und eines immer aggressiveren Marktumfelds konnte der Gesamtumsatz der Gruppe um 1,6 Prozent gesteigert werden. Das Ergebnis vor Zinsen, Steuern und Abschreibungen (EBITDA) in Höhe von 282,5 Millionen Euro ist im Vergleich zum Vorjahr (312,4 Millionen Euro) nur leicht zurückgegangen. Grund dafür ist in erster Linie der Krieg in der Ukraine und die damit verbundenen bilanziellen Vorsorgemassnahmen.

„Den letztjährigen Erfolg verdanken wir in erster Linie unseren mehr als 6.000 Mitarbeitenden in 24 Ländern, die EOS in einer volatilen Zeit jeden Tag dynamischer und digitaler machen“, betont Marwin Ramcke, CEO der EOS Gruppe. „Das vergangene Geschäftsjahr zeichnet sich vor allem durch drei Aspekte aus: Zunächst haben wir unsere Kernkompetenzen im Ankauf und der Bearbeitung notleidender Forderungen ausbauen und uns als Experten beweisen können. Ergänzt wurde das durch die hervorragende internationale Zusammenarbeit und länderübergreifende Kooperation zwischen unseren Standorten in 24 Ländern. Und zuletzt hat es uns die wachsende Automatisierung ermöglicht, unsere Geschäftsprozesse stetig zu verbessern. Leistungen, auf die wir in einem herausfordernden Jahr als Team sehr stolz sein können“, so Ramcke weiter.

EOS stärkt führende Position und treibt Digitalisierung voran

Die EOS Gruppe hat über die Jahre eine sehr gute Reputation erarbeitet – sowohl als internationaler Inkassodienstleister als auch Investor in Forderungspakete (NPL). Mit der Finanzstärke der Otto Group im Rücken war EOS in der Lage, wieder signifikante Investitionen auf dem Markt für NPL zu tätigen. Der deutliche Fokus auf der Prozessautomatisierung sowie der Einsatz einer datengetriebenen Inkasso-Software ermöglicht zudem eine erfolgreichere und effizientere Bearbeitung von Forderungen.

„Wir haben vielversprechende Fortschritte in Bezug auf einen gemeinsamen analytischen Datenhaushalt gemacht, der uns in der Steuerung künftig klar voranbringen wird. Die damit verbundene Investition war und ist ein grosser Schritt hin zu einer vollständig digitalisierten Unternehmensgruppe“, sagt Justus Hecking-Veltman, CFO der EOS Gruppe. Die Entwicklung und Nutzung von Chatbots in der Kommunikation mit Verbraucher*innen oder 24/7 Serviceportale, die bereits in mehreren Ländern implementiert wurden, sind weitere Beispiele für die digitale Transformation bei EOS.

Mit seiner langjährigen Expertise als Inkassounternehmen und seinem Fokus auf Digitalisierung und internationaler Vernetzung, konnte EOS im Geschäftsjahr 2021/22 in vielen Märkten seine führende Position im Forderungsmanagement festigen und weiter ausbauen. Insbesondere im Bereich des Forderungskaufs war das Geschäftsjahr für EOS ein Rekordjahr: Insgesamt 669 Millionen Euro investierte die Gruppe in diesem Zeitraum in NPL und Immobilien. Mit diesem Ergebnis wurde das Volumen des letzten Geschäftsjahres deutlich übertroffen.

EOS setzt ambitioniertes Nachhaltigkeitskonzept um

Mit der zu Beginn des letzten Geschäftsjahres vorgestellten Corporate Responsibility (CR)-Strategie geht die Gruppe das eigene Nachhaltigkeitsengagement strukturiert und mit ambitionierten Zielen an. Der Beitritt zum UN Global Compact unterstreicht die Bestrebungen von EOS nachdrücklich. An der Initiative der Vereinten Nationen partizipieren mittlerweile mehr als 16.000 Unternehmen aus über 160 Ländern, mit dem Ziel die Welt nachhaltiger und fairer zu machen. Die zahlreichen CR-Aktivitäten von EOS reichen weit über den Umweltschutz hinaus – und das soziale und unternehmerische Engagement trägt bereits Früchte: Mit dem Top Women Leaders Awards und der Gold-Medaille der renommierten Rating-Agentur EcoVadis hat die EOS Gruppe im Laufe des vergangenen Geschäftsjahres bereits zwei Auszeichnungen für ihre Bemühungen im CR-Bereich erhalten.

Die bestehenden Nachhaltigkeitsinitiativen sollen auch im kommenden Jahr weiter vorangetrieben werden. „Wir übernehmen Verantwortung – nicht nur für die eigenen Mitarbeiter*innen und Kund*innen, sondern auch für Verbraucher*innen und die gesamte Inkassobranche. Oder kurz: Changing for the better“, sagt Ramcke. „Persönlich möchte ich vor allem das Thema Diversity vorantreiben. Das ist eine der grössten Stärken unserer internationalen Gruppe. So haben engagierte Mitarbeiter*innen im letzten Jahr die LGBTQ+ Community Queer@EOS und das Frauennetzwerk W:isible gegründet.“

Westeuropa: Signifikate Umsatzsteigerung und kontinuierliches Wachstum

In Westeuropa verzeichneten die Landesgesellschaften ein Umsatzwachstum von 9 Prozent. Insbesondere Frankreich, Spanien und Dänemark meldeten einen deutlichen Ergebniszuwachs. Es gab grosse Nachholeffekte im NPL-Bereich, die auf das Abflauen der Pandemie zurückzuführen sind. Da in vielen Ländern Westeuropas die Gerichte und Beitreibungsämter pandemiebedingt lange geschlossen waren, hat die weitestgehende Rückkehr zum Regelbetrieb die Bearbeitung von in den Vorjahren erworbenen NPL-Portfolios enorm erleichtert und die operative Performance in Ländern wie Frankreich und Belgien stark gesteigert. „Zudem haben wir in Westeuropa 144,5 Mio. Euro in Forderungspakete und Immobilien investiert. Die EOS Landesgesellschaft in Spanien kaufte ebenfalls erfolgreich ihr erstes besichertes NPL-Portfolio. Das ist ein wichtiger Schritt für die Region“, berichtet Dr. Andreas Witzig, Geschäftsführer der EOS Gruppe, verantwortlich für Westeuropa. „Wir werden unsere Position auf dem NPL-Markt weiter ausbauen und noch aktiver werden – gerade was besicherte Forderungen angeht“, betont Witzig.

Weiterführende Informationen zum Geschäftsjahr 2021/22 sowie den Jahresbericht zum Download finden Sie im im ePaper Jahresbericht 21/22.

Über die EOS Gruppe

Die EOS Gruppe ist ein führender technologiebasierter Investor in Forderungsportfolios und Experte bei der Bearbeitung offener Forderungen. Mit über 45 Jahren Erfahrung und Standorten in 24 Ländern (Stand Geschäftsjahresende 2021/22) bietet EOS seinen rund 20.000 Kund*innen weltweit smarte Services rund ums Forderungsmanagement. Im Fokus stehen Banken sowie Unternehmen aus den Bereichen Immobilien, Telekommunikation, Versicherungen, Mobilität, Energieversorgung und E-Commerce. EOS beschäftigt mehr als 6.000 Mitarbeiter*innen und gehört zur Otto Group.

Weitere Informationen zu EOS: eos-schweiz.com

Kloten, 5. Juli 2022 – Der Verwaltungsrat des Finanzdienstleistungsunternehmens EOS Schweiz AG hat Andreas Hasler per 1. Juli 2022 zum neuen CEO ernannt. Er folgt auf Alex Schneider, der sich nach sieben Jahren an der Spitze von EOS Schweiz einer neuen Herausforderung stellen wird.

Leader-Persönlichkeit mit langjähriger Finance-Erfahrung

Andreas Hasler verfügt über eine reiche, internationale Führungserfahrung genauso wie über profunde Kenntnisse in den Bereichen Finance, Risiko Management, Sales & Marketing sowie Compliance und Financial Reporting. Der 48jährige Schweizer war rund 15 Jahre lang in verschiedenen Funktionen in Finanzunternehmen der Ford-Gruppe tätig, zuletzt als CEO der Ford Bank Austria in Salzburg.

Bei EOS Schweiz wird Hasler verstärkt die Innovation und Digitalisierung, inklusive dem Einsatz von auf künstlicher Intelligenz basierten Inkassoprozesse, vorantreiben.

Sieben erfolgreiche Jahre

Nach 14 Jahren bei EOS Schweiz / Alphapay, davon zuletzt 7 Jahre als CEO, wird Alex Schneider EOS verlassen, um künftig eine neue Herausforderung wahrzunehmen. Der Verwaltungsratspräsident Andreas Witzig: «Ich danke Alex Schneider für seinen langjährigen Einsatz für EOS, insbesondere in den letzten 7 Jahres als CEO. Ich wünsche ihm viel Erfolg bei seinen neuen Aufgaben.»

Über EOS Schweiz

EOS Schweiz zählt zu den führenden Schweizer Dienstleistern im Forderungsmanagement und ist Experte bei der Bearbeitung offener Forderungen. EOS ist an 3 Standorten in der Romandie, der Deutschschweiz und im Tessin präsent und beschäftigt zurzeit rund 100 Mitarbeitende.

EOS Schweiz ist Teil der EOS Gruppe, die mit Standorten in 24 Ländern ihren rund 20.000 Kund*innen weltweit smarte Services rund ums Forderungsmanagement bietet. Im Fokus stehen Banken sowie Unternehmen aus den Bereichen Immobilien, Telekommunikation, Energieversorgung und E-Commerce. Die EOS Gruppe beschäftigt mehr als 6‘000 Mitarbeiter*innen und gehört zur Otto Group.

Weitere Informationen über EOS Schweiz: eos-schweiz.com

Weitere Informationen zur EOS Gruppe: eos-solutions.com

Hamburg, 6. April 2022 – Die EOS Gruppe tritt ab sofort mit veränderter Corporate Identity auf. Mit neuem Logo und Corporate Design präsentiert sich der internationale Finanzdienstleister als moderner Player auf dem europäischen Markt für Forderungsmanagement. „Mit der neuen Marke unterstreichen wir deutlich unseren Anspruch, den wir bereits im letzten Jahr mit der Einführung unseres Claims ‚Changing finances for the better‘ kommuniziert haben“, sagt Marwin Ramcke, seit Februar neuer CEO der EOS Gruppe: „Mit über 6.000 Mitarbeitenden in 24 Ländern arbeiten wir täglich daran, die finanzielle Situation unserer Kund*innen, Partnerunternehmen sowie der säumigen Verbraucher*innen zum Besseren zu verändern. Dazu investieren wir massiv in Digitalisierung, setzen immer stärker auf KI-basierte Inkassoprozesse und auf unsere internationale Vernetzung.“

Designanpassung zeigt den Wandel von EOS

Ziel des Konzerns, der im Geschäftsjahr 2020/21 einen Umsatz in Höhe von 792,5 Millionen Euro erzielt hat, ist der weltweite Marken-Rollout innerhalb der kommenden zwölf Monate. „Ich freue mich, dass sich die Geschäftsführung gegen eine evolutionäre Weiterentwicklung der Marke und bewusst für einen disruptiven Design-Sprung entschieden hat“, betont Lara Flemming, Senior Vice President Corporate Communications & Marketing bei EOS. „Hätten wir die Marke nur leicht angepasst, wären wir dem starken Wandel, den EOS in den letzten Jahren durchlaufen hat, nicht gerecht geworden. Nun können wir es kaum erwarten, den neuen EOS Auftritt gemeinsam mit unseren internationalen Kolleg*innen an allen Touchpoints sichtbar zu machen.“

Im Fokus des Relaunches stehen Kund*innen und potenzielle Mitarbeitende. „Mit dem neuen Auftritt möchten wir noch mehr Unternehmen davon überzeugen, dass EOS der beste Partner für den Ankauf und die Bearbeitung offener Forderungen ist“, so Flemming. „Um unserem eigenen Anspruch gerecht zu werden, suchen wir europaweit immer neue Talente, die uns voranbringen. Unsere Mitarbeitenden sind unser wichtigstes Gut. Deshalb positionieren wir uns bei High Potentials als moderner und attraktiver Arbeitgeber.“ Unterstützt wurde EOS beim Marken-Relaunch federführend von der Hamburger Design-Agentur Syndicate.

Neues Logo steht für Internationalität, Fokus und Dynamik

Das neue Logo wurde von der Box befreit, die den Schriftzug jahrelang umrahmt hat. „Nichts soll uns im Denken und Handeln einschränken“, sagt Flemming. Das kleingeschriebene ‘e‘ im neuen EOS Logo verkörpert die Internationalität und die fortschreitende Digitalisierung des Konzerns. „Im Englischen, der globalen Sprache schlechthin, werden ja die meisten Worte kleingeschrieben“, erklärt Flemming. „Zudem kennt man das kleine ‚e‘ aus Business-Begriffen wie dem e-commerce, wo es für elektronische, also digitale Prozesse steht. Für uns war es daher sehr passend, unseren Unternehmensnamen im Logo künftig mit kleinem Buchstaben zu schreiben.“ Das grosse ‚O‘ in der Mitte des Logos symbolisiert den Fokus und die starke Zielorientierung von EOS. Am Ende verleiht ein bewusst unvollendetes ‚s‘ dem Logo Dynamik. Es zeigt die Veränderungslust des Unternehmens, das sich seit Gründung 1974 immer wieder neu erfunden hat. „Die Welt verändert sich heute schneller als jemals zuvor. Wir gestalten diesen Wandel aktiv mit. Das ‚s‘ im Logo sagt, dass wir nie mit unserer Entwicklung fertig sein werden und uns immer wieder den Umständen anpassen wollen“, so CEO Ramcke. „Mit der neuen Marke unterstreichen wir, dass wir weiterhin Massstäbe setzen wollen – über die Inkassobranche hinaus in der gesamten europäischen Finanzbranche.“

Über die EOS Gruppe

Die EOS Gruppe ist ein führender technologiebasierter Investor in Forderungsportfolios und Experte bei der Bearbeitung offener Forderungen. Mit über 45 Jahren Erfahrung und Standorten in 24 Ländern bietet EOS seinen rund 20.000 Kund*innen weltweit smarte Services rund ums Forderungsmanagement. Im Fokus stehen Banken sowie Unternehmen aus den Bereichen Immobilien, Telekommunikation, Energieversorgung und E-Commerce. EOS beschäftigt mehr als 6.000 Mitarbeiter*innen und gehört zur Otto Group.

Weitere Informationen zur EOS Gruppe: eos-solutions.com

- Zwei von drei europäischen Unternehmen im Privatkundensegment nutzen Chatbots in der Kund*innenkommunikation

- Fast jedes zweite Kund*innenanliegen über Chatbots wird bereits komplett eigenständig gelöst

- Der Druck wächst: 61 Prozent gehen fest davon aus, dass langfristig jedes grosse Unternehmen einen Chatbot anbieten muss

Hamburg / Kloten, 15. November 2021 – Der direkte und schnelle Kontakt zum Kund*innenservice war während der Corona-Pandemie aufgrund von Kurzarbeit oder fehlenden Ressourcen eine Herausforderung. Dadurch haben Chatbots noch einmal an Bedeutung gewonnen, wie eine aktuelle Studie des Finanzdienstleisters und

-investors EOS in 14 europäischen Ländern zeigt. Demnach werden Chatbots bereits bei zwei von drei Unternehmen im Privatkundensegment eingesetzt. Weiterhin stellt sich heraus, dass Chatbots 30 Prozent der digitalen Kund*innenkommunikation ausmachen und fast jedes zweite Anliegen, das an einen Chatbot gerichtet ist, von diesem komplett bearbeitet wird. Auch EOS selbst setzt auf die digitalen Helfer: In Kroatien, Frankreich und Belgien sind bereits Chatbots im Einsatz und kommunizieren mit säumigen Zahler*innen.

„Seit dem Rollout unseres Chatbots Tom sind die Anrufe im Servicecenter zurückgegangen“, sagt Wesley van de Walle, Projektverantwortlicher beim belgischen Unternehmen EOS Contentia. „Im Schnitt führt Tom monatlich über 300 Gespräche mit säumigen Zahler*innen zu einfachen Anliegen. Seit dem letzten Update ist er zudem direkt an unser Inkasso-System angebunden und kann nun persönliche Daten verarbeiten. Nach der Authentifizierung erfahren User*innen auf Nachfrage die Höhe der Schulden, den Zeitpunkt der nächsten anfallenden Zahlung oder entstandene Kosten. Ein echter Mehrwert“, so van de Walle.

Besonders in Polen und der Schweiz sind Chatbots beliebt

Im europäischen Vergleich zeigen sich der EOS Studie zufolge noch Unterschiede beim Einsatz der Technologie: Während in Polen und der Schweiz Chatbots mit Nutzungsraten von über 70 Prozent ganz hoch im Kurs stehen, sieht das in Frankreich (54 Prozent) und Russland (46 Prozent) noch etwas zurückhaltender aus. Eingesetzt werden die digitalen Helfer aktuell primär zum Erstkontakt (97 Prozent), gefolgt vom Kund*innenservice (51 Prozent) und der Produktberatung (39 Prozent).

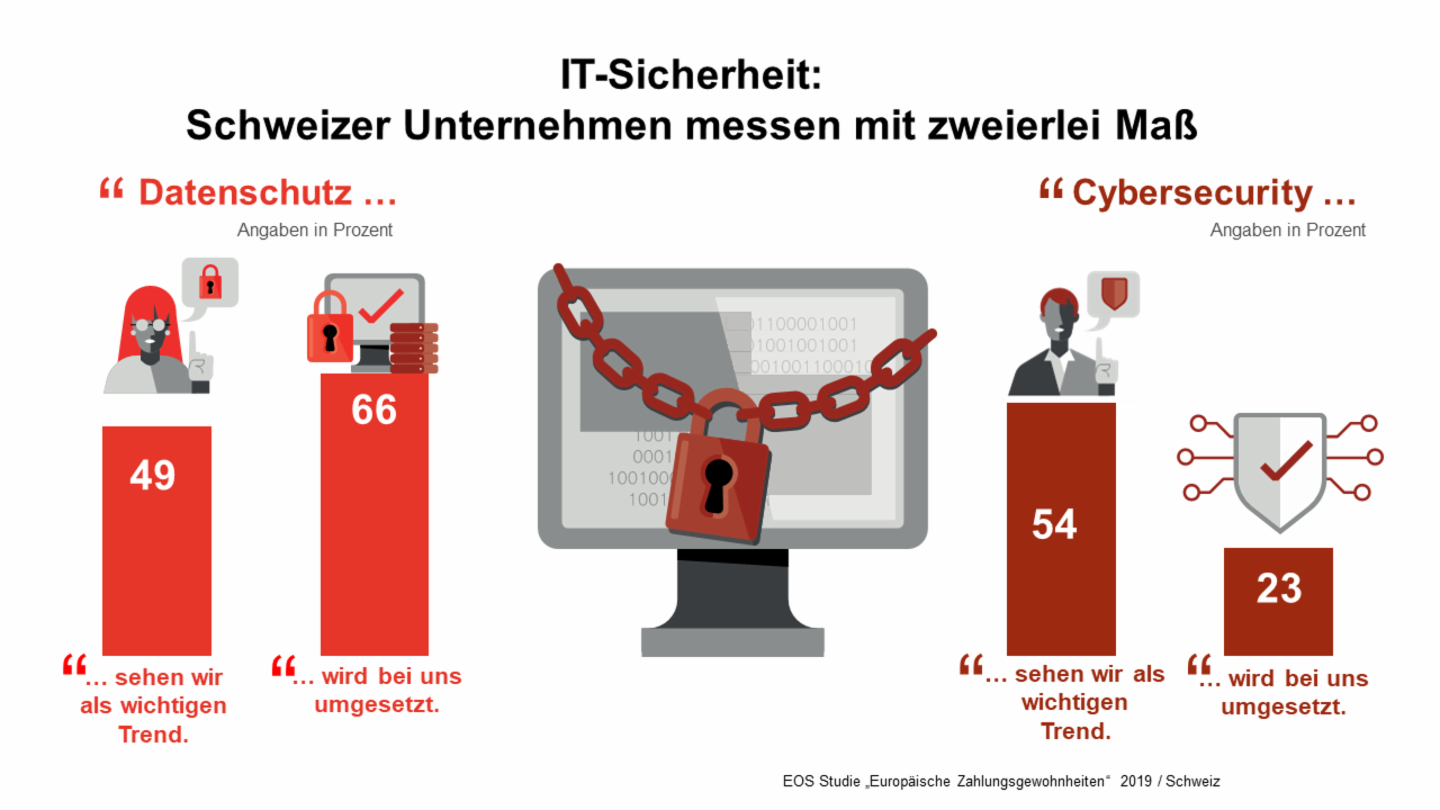

Herausforderungen: Was Chatbots noch bremst

Als grösste Herausforderungen für den Chatbot-Einsatz identifizieren die befragten Unternehmen den Datenschutz (70 Prozent), gefolgt von der erforderlichen Überarbeitung ihrer Datenstrukturen zur Einführung (59 Prozent). Die Investitionskosten sind hingegen selten eine Hürde: Nur 27 Prozent der Unternehmen bewerten die Kosten für die Einführung eines Chatbots als „hoch“, lediglich drei Prozent haben sich aus Kostengründen gegen den Einsatz der Technologie entschieden.

„Die hohen Datenschutz-Anforderungen zu erfüllen, ist für EOS selbstverständlich. Die Herausforderung bei der Chatbot-Entwicklung in unserem Geschäft mit sensiblen Daten ist es eher, die Balance zwischen einfacher Bedienbarkeit und der nötigen Sicherheit zu finden“, sagt Franjo Glibo, Leiter der IT-Abteilung von EOS in Kroatien und verantwortlich für dessen Bot. „Unternehmen sollten offen kommunizieren und aufzeigen, was Verbraucher*innen von der Preisgabe ihrer Daten haben. Bei EOS können sie beispielsweise für das bestmögliche, individuelle Forderungsmanagement genutzt werden – mit Vorteilen auch für säumige Zahler*innen.“

Zunehmend intelligente Chatbots: Eine Technologie mit Zukunft

Laut der EOS Chatbot-Studie 2021 setzen Unternehmen aktuell hauptsächlich Bots mit mittlerem Intelligenzgrad ein (57 Prozent), deren Aufgaben in der thematischen Vorselektion und Abwicklung von Teilleistungen liegen. Dass sich diese in den nächsten Jahren weiter verbessern müssen, sehen nicht nur die EOS Expert*innen so, sondern auch die Studienbefragten planen zu 88 Prozent eine Weiterentwicklung ihrer Bots. Einig sind sich alle Länder, dass die Bedeutung von Chatbots in den nächsten 24 Monaten weiter zunehmen und die Akzeptanz von Kund*innen ansteigen werde. 61 Prozent der Befragten sind zudem überzeugt, dass jedes grosse Unternehmen mittelfristig einen Chatbot anbieten sollte.

Über die repräsentative EOS Chatbot-Studie 2021

Die repräsentative EOS Studie fand im Zeitraum April-Juni 2021 in 14 europäischen Ländern statt. Hierfür wurden jeweils 200 B2C-Unternehmen in computerassistierten Telefon-Interviews befragt. Die insgesamt 2.800 Entscheidungsträger*innen aus Deutschland, Dänemark, Belgien, Schweiz, Spanien, Frankreich, Polen, Slowakei, Slowenien, Kroatien, Ungarn, Bulgarien, Rumänien und Russland beantworteten unter anderem Fragen zum Einsatz von Chatbots, der Akzeptanz der Nutzer*innen und den möglichen Chancen für die Zukunft.

Über die EOS Gruppe

Die EOS Gruppe ist ein führender technologiebasierter Investor in Forderungsportfolios und Experte bei der Bearbeitung offener Forderungen. Mit über 45 Jahren Erfahrung und Standorten in 24 Ländern (Stand Geschäftsjahresende 2021/22) bietet EOS seinen rund 20.000 Kund*innen weltweit smarte Services rund ums Forderungsmanagement. Im Fokus stehen Banken sowie Unternehmen aus den Bereichen Immobilien, Telekommunikation, Versicherungen, Mobilität, Energieversorgung und E-Commerce. EOS beschäftigt mehr als 6.000 Mitarbeiter*innen und gehört zur Otto Group.

Weitere Informationen zu EOS: eos-schweiz.com

Pressekontakt

Basil Schneuwly, Manager Marketing & Communication

E-Mail: [email protected]

Tel.: +41 58 411 73 03

- Grosse Chance für Unternehmen: Mehr als ein Drittel der Verbraucher*innen befürwortet „Gegenleistung für Daten“

- Die Mehrheit ist bereit, mindestens eine persönliche Angabe an vertrauensvolle Unternehmen zu verkaufen

- Bereitschaft zur Datenfreigabe übersteigt zum Teil sogar die Nachfrage

Kloten, 8. Oktober 2020 – In der heutigen digitalen Welt sind Daten wie Kontonummer, Geburtsdatum, Adresse, Gesundheitsfakten oder Kaufverhalten zu einem zentralen Wirtschaftsgut geworden. Daher bestimmen der Umgang mit Daten und ihr Wert sowie die Wertschätzung für deren Nutzung von Seiten der Unternehmen immer stärker den öffentlichen Diskurs. Das bestätigt auch eine aktuelle repräsentative Studie in 17 Ländern zum Thema „Was sind Daten wert?“ des Finanzdienstleisters und ‑investors EOS. Demnach finden über 60 Prozent der Verbraucher*innen in Europa und den USA sowie sogar 70 Prozent in Russland, dass Unternehmen ihre Kund*innen für die Nutzung ihrer Daten entschädigen sollten. Bereit, bestimmte Daten für eine Gegenleistung zur Verfügung zu stellen, ist mehr als ein Drittel der Befragten – in Russland sogar die Hälfte.

Vertrauen und Vergütung als Treiber zu stärkerer Datenpreisgabe

Damit Menschen bereit sind, persönliche Daten preiszugeben, sind Vertrauen in den verantwortungsvollen Umgang mit Daten sowie die Einhaltung gesetzlicher Richtlinien entscheidend. Laut EOS Studie würde die deutliche Mehrheit der Verbraucher*innen einem vertrauenswürdigen Unternehmen mindestens eine persönliche Angabe für Geld verkaufen (Europa: 82 Prozent, USA: 75 Prozent, Russland: 90 Prozent). Am unbedenklichsten gesehen werden die Preisgabe von Kaufentscheidungen sowie Vorlieben für Produkte und Marken. Besonders schützenswert sind hingegen Konto- oder Kreditkartendaten sowie Einblicke ins Bankkonto. Nach dem konkreten Vergütungswunsch gefragt, sind für über die Hälfte der Befragten vor allem Sachprämien und Rabatte attraktiv, während Serviceleistungen in allen Regionen weniger gefragt sind und nur von rund 20 Prozent befürwortet werden.

Datenanalyse als Grundlage für modernes Forderungsmanagement

Dass es sich für Unternehmen lohnt, Verbraucher*innen zur Preisgabe von Daten zu motivieren, zeigt der Blick ins Forderungsmanagement. Denn: Je besser die Daten sind, die über den Käufer eines Produkts oder einer Dienstleistung vorliegen, desto schneller lässt sich dieser im Falle eines Zahlungsausfalls erreichen. Und: Je mehr Erfahrungswerte aus vergleichbaren Forderungsfällen schon vorhanden sind, desto besser passt der vorgeschlagene Ratenplan zur finanziellen Situation der Kund*innen. Die Folge: er wird verlässlicher eingehalten. Beim Inkassodienstleister EOS kommt daher dem Center of Analytics eine zentrale Rolle zu. Dessen Plattform wertet mithilfe von Machine-Learning-Algorithmen tausende von Inkassovorgängen aus und berechnet so die besten nächsten Bearbeitungsschritte.

Bereitschaft zur Datenfreigabe übersteigt teilweise sogar die Nachfrage

Laut der EOS Studie ist jedem*r fünften Verbraucher*in für die Preisgabe bestimmter Daten bereits eine Gegenleistung angeboten worden. In Europa heben sich Spanien und Rumänien hervor: Hier ist es sogar jede*r Vierte. Teilweise übersteigt jedoch die Bereitschaft zur Freigabe das tatsächliche Angebot an Gegenleistungen von Seiten der Unternehmen. „Ich sehe hier noch grosse Chancen und ungenutztes Potenzial“, betont Joachim Göller.

„Schon heute werden Ratenpläne in vielen EOS Ländern auf Basis intelligenter Datenanalyse erstellt“, erläutert Joachim Göller, Head of Center of Analytics. „Es liegt im Interesse aller Beteiligten, einen Forderungsfall möglichst schnell abzuschliessen, um Kosten auf beiden Seiten zu sparen. Dabei helfen Daten. Je eher der Kontakt zustande kommt und je besser die Zahlungsvereinbarung eingehalten werden kann, desto eher kommt der Gläubiger an sein Geld und wird der Verbraucher schuldenfrei. Daten preiszugeben kann also durchaus im Sinne des säumigen Zahlers sein.“

Über die repräsentative EOS Studie „Was sind Daten wert?“ 2020

Die EOS Studie, die in Kooperation mit dem Marktforschungsinstitut Kantar im Frühjahr 2020 durchgeführt wurde, ist repräsentativ für die (Online-)Bevölkerung ab 18 Jahren in den 17 untersuchten Ländern. Eine Stichprobe von jeweils 1.000 Befragten aus Belgien, Bulgarien, Deutschland, Frankreich, Grossbritannien, Kroatien, Polen, Rumänien, Russland, der Schweiz, Serbien, der Slowakei, Slowenien, Spanien, Tschechien und den USA sowie von 300 Befragten aus Nordmazedonien wurde für die Auswertung verwendet. Die Teilnehmer*innen beantworteten Fragen zu ihrem persönlichen Umgang mit Daten und deren Freigabe, ihrem Vertrauen in Unternehmen sowie ihrer Bereitschaft, Daten gegen Vergütung zu veräussern.

Weitere Informationen zur Umfrage finden Sie hier.

Über die EOS Gruppe

Die EOS Gruppe ist einer der führenden technologiebasierten Finanzinvestoren und Experte bei der Bearbeitung offener Forderungen. Schwerpunkt ist der Ankauf von unbesicherten und besicherten Forderungsportfolios. Mit über 40 Jahren Erfahrung und Standorten in 26 Ländern bietet EOS seinen rund 20.000 Kunden weltweit smarte Services rund ums Forderungsmanagement. Hauptzielbranchen sind Banken, Versorgungsunternehmen, der Immobiliensektor sowie E-Commerce. EOS beschäftigt mehr als 7.500 Mitarbeiterinnen und Mitarbeiter und gehört zur Otto Group.

Weitere Informationen zur EOS Gruppe: eos-solutions.com

- Nur 31 Prozent der Schweizer*innen vertrauen Unternehmen im Umgang mit digitalen Daten

- Das grösste Vertrauen geniessen Banken und Energieversorger; Verlierer im Vertrauensranking sind Telekommunikationsunternehmen, der Onlinehandel sowie Soziale Netzwerke und Messenger

Kloten, 7. Oktober 2020 – Der verantwortungsvolle Umgang mit dem wertvollen Gut „Digitale Daten“ ist wichtiger denn je. Denn: Sie helfen Unternehmen, ihre Kund*innen und deren Wünsche besser zu verstehen sowie auf Markttrends zu reagieren. Die Datenpreisgabe seitens der Verbraucher*innen ist jedoch massgeblich an Vertrauen gekoppelt. Darum steht es bislang nicht sehr gut: Nur 33 Prozent der Europäer*innen vertrauen Unternehmen im Umgang mit digitalen Daten. In der Schweiz sind es nur 31 Prozent. Noch misstrauischer sind die Amerikaner*innen (23 Prozent), während man in Russland etwas weniger skeptisch ist (41 Prozent). Das belegt eine aktuelle repräsentative Studie des Finanzdienstleisters und -investors EOS in 17 Ländern zum Thema „Was sind Daten wert?“. Begründet liegt diese Skepsis teilweise in schlechten Erfahrungen mit der Datenweitergabe. Jede*r vierte bis fünfte Verbraucher*in hatte diesbezüglich schon einmal Negativerlebnisse im Internet.

Deutliche Vertrauensunterschiede je nach Branche und Art der Daten

Mit Blick auf die Branchen gibt es deutliche Unterschiede: Das grösste Vertrauen im Umgang mit Kundendaten geniessen Banken und Finanzdienstleister (Europa: 54 Prozent, USA: 56 Prozent, Russland: 54 Prozent) – allerdings nicht uneingeschränkt über alle Länder hinweg. Auch Energieversorger und Versicherungen schneiden noch ganz gut ab (Ø über alle Länder 39 Prozent). Wenig Vertrauen geniessen hingegen Telekommunikationsunternehmen (Ø 28 Prozent), der Onlinehandel (Ø 21 Prozent) sowie Soziale Netzwerke und Messenger (Ø 14 Prozent). Dass bei Letzteren dennoch Daten preisgegeben werden (Kontaktinformationen, Bewegungsprofile, Kauf- und Surfverhalten), kann darin begründet liegen, dass diese von den Nutzer*innen als weniger sensibel angesehen werden. Global als am schützenswertesten angesehen werden Finanzdaten.

Datensparsamkeit und Servicequalität schaffen Vertrauen

Gerade Finanzdienstleister können also vom Vertrauensvorsprung in Bezug auf Datennutzung profitieren. Sie müssen jedoch den Spagat schaffen, Prozesse durch möglichst viele Daten zu optimieren und dennoch unnötige Datenabfragen zu vermeiden. Vor dieser Herausforderung steht auch EOS. Für den Inkassodienstleister und Auftraggeber der Studie sind in den Bereichen Datenschutz und Informationssicherheit weltweit rund 60 Mitarbeitende im Einsatz. „Um sowohl bei unseren Auftraggebern als auch den Verbraucher*innen Vertrauen aufzubauen, machen wir Datensparsamkeit bei EOS schon beim Aufsetzen von Projekten zum Thema. Statt des Mottos ‚Haben ist besser als nicht haben‘ verfolgen wir einen Minimierungsansatz und erheben Daten immer nur zweckgebunden“, erläutert Stephan Bovermann, Senior Group Privacy Officer der EOS Gruppe. Gemeinsam mit seinen Kolleg*innen kümmert er sich darum, den Datenschutz in allen 26 EOS Ländern weltweit sicherzustellen. Der verantwortungsvolle Umgang mit Daten ist aus seiner Sicht aber lediglich ein Teil der vertrauensbildenden Massnahmen. „Eine hohe Produkt- und Servicequalität zahlen selbstverständlich ebenso aufs Vertrauenskonto eines Unternehmens ein wie dessen sorgfältiger Umgang mit den anvertrauten Daten“, betont Bovermann.

Datenminimierung durch Digitale Self-Service-Portale

Ein Beispiel für den Daten-Minimierungsansatz sind die Serviceportale von EOS, über die säumige Zahler*innen ihre offenen Forderungen begleichen können. Dort werden nur Daten erhoben, die für den Zahlvorgang notwendig sind. Das schafft Vertrauen, weiss Esther van Oirsouw, Head of Portals & Integration bei EOS Technology Solutions: „Unsere Online-Portale ermöglichen säumigen Zahler*innen einen einfachen und selbstbestimmten Zugang zu ihrer offenen Forderung. Nach Eingabe der individuellen Fallnummer lassen sich in wenigen Klicks Zahlungen vornehmen. Dafür müssen bei der überwiegenden Mehrheit der angebotenen Zahlungsarten keine persönlichen Daten eingegeben werden. Damit ist die Hürde extrem gering, denn aus Erfahrung wissen wir: Je mehr Selbstbestimmung und Flexibilität wir schaffen, desto besser ist auch die Zahlungsquote und desto höher das Vertrauen in uns.“

Handlungsbedarf über alle Ländergrenzen hinweg

Wie die Studie zeigt, ist digitales Vertrauen zu gewinnen und auszubauen für viele Unternehmen noch eine grosse Baustelle. Länderübergreifend sind Misstrauen und Skepsis auf Verbraucher*innenseite ähnlich gross. Dabei wird klar: Die digitale Welt ist ein Gleichmacher. Wer Teil des digitalen Kosmos sein möchte, trifft im internationalen Vergleich auf die gleichen globalen Player und ist deren Regeln unterworfen. Viele Befragte haben das Gefühl, oftmals keine Wahl in Bezug auf die Freigabe ihrer Daten zu haben: Rund zwei Drittel der Europäer*innen (66 Prozent) und Amerikaner*innen (58 Prozent) sowie vier von fünf russischen Verbraucher*innen (81 Prozent) beklagen, dass sie ohne Datenpreisgabe viele Online-Dienste gar nicht umfassend nutzen können. Zudem sehen sich rund 60 Prozent nicht ausreichend informiert, um die Freigabe von Daten verhindern oder einschränken zu können.

Über die repräsentative EOS Studie „Was sind Daten wert?“ 2020

Die EOS Studie, die in Kooperation mit dem Marktforschungsinstitut Kantar im Frühjahr 2020 durchgeführt wurde, ist repräsentativ für die (Online-)Bevölkerung ab 18 Jahren in den 17 untersuchten Ländern. Eine Stichprobe von jeweils 1.000 Befragten aus Belgien, Bulgarien, Deutschland, Frankreich, Grossbritannien, Kroatien, Polen, Rumänien, Russland, der Schweiz, Serbien, der Slowakei, Slowenien, Spanien, Tschechien und den USA sowie von 300 Befragten aus Nordmazedonien wurde für die Auswertung verwendet. Die Teilnehmer*innen beantworteten Fragen zu ihrem persönlichen Umgang mit Daten und deren Freigabe, ihrem Vertrauen in Unternehmen sowie ihrer Bereitschaft, Daten gegen Vergütung zu veräussern.

Weitere Informationen zur Umfrage finden Sie hier.

Über die EOS Gruppe

Die EOS Gruppe ist einer der führenden technologiebasierten Finanzinvestoren und Experte bei der Bearbeitung offener Forderungen. Schwerpunkt ist der Ankauf von unbesicherten und besicherten Forderungsportfolios. Mit über 40 Jahren Erfahrung und Standorten in 26 Ländern bietet EOS seinen rund 20.000 Kunden weltweit smarte Services rund ums Forderungsmanagement. Hauptzielbranchen sind Banken, Versorgungsunternehmen, der Immobiliensektor sowie E-Commerce. EOS beschäftigt mehr als 7.500 Mitarbeiterinnen und Mitarbeiter und gehört zur Otto Group.

Weitere Informationen zur EOS Gruppe: eos-solutions.com