We keep you updated

- EOS Group achieves second highest earnings in 50-year history

- ESG risk rating from Morningstar Sustainalytics: EOS Group one of top 3 in “Consumer Finance” sector

- Corporate Responsibility (CR): EOS publishes second combined annual and sustainability report

Achieving the second-highest earnings (EBITDA) in the company’s 50-year history – EUR 412.9 million – in the 2023/24 financial year, the EOS Group has sustained a very good level with a 2.1% increase in sales (totaling EUR 997.3 million). At the same time, the investment volume of around EUR 583.5 million was significantly lower than in the exceptional financial year of 2022/23. Successful management of the receivables portfolios acquired in previous years contributed significantly to the overall positive result.

Successful performance despite a challenging economic climate

Despite macroeconomic challenges such as rising interest rates and high inflation, the EOS Group once again succeeded in attaining an impressive EBITDA of over EUR 400 million in the past financial year according to Marwin Ramcke, CEO of the EOS Group. “While the uncertain macroeconomic times are bound to persist, we have nevertheless made dealing with uncertainty at a professional level our strength, have demonstrated our ability to act with resilience and the required flexibility, and are focused on achieving the best solutions for our customers,” Ramcke goes on to say.

The fact that the EOS Group has once again achieved very good earnings despite the difficult macroeconomic situation is due in particular to the outstanding performance of the international teams in recent years, stresses Justus Hecking-Veltman, CFO of the EOS Group at the time the annual financial statements were prepared. Overall, while investments have fallen significantly compared to the exceptional financial year of 2022/23, significant purchases of receivables in the double or triple-digit million range have confirmed the strong market position, Hecking-Veltman adds. “For this reason, the purchase of receivables portfolios will also remain a key focus area of the EOS Group in the future.”

On August 1, 2024, Hecking-Veltman left the company to pursue other challenges. His successor will be Dr. Eva Griewel, who has a PhD in economics.

Eastern Europe slightly exceeds last year’s sales level

With a share of 41.9 percent in overall sales, Eastern Europe is the strongest performing region within the EOS Group. Particularly the companies in Bosnia and Herzegovina, Bulgaria, Greece, and Poland were able to achieve significant increases in sales. Despite rising interest rates, investments amounting to EUR 212.5 million were made. “This is thanks to all our colleagues who have left their comfort zone to break new ground,” says Carsten Tidow, who is responsible for the region of Eastern Europe on the Executive Board.

Western Europe’s growth the strongest with sales up 6.9 percent

At EUR 323.4 million (32.4 percent of total sales), sales in the region of Western Europe increased the most compared to the other regions of the EOS Group (6.9 percent in all). According to Sebastian Pollmer, responsible for the region of Western Europe since the beginning of the 2024/25 financial year, the successful management of existing receivables portfolios is the main reason for this positive development. Deserving special mention is the company in France, whose financial performance has been particularly strong. Together with a co-investor, EOS France purchased a record portfolio with a nominal value of EUR 364 million. The companies in Denmark and Portugal, the latter already established on the market after two short years, have also made a valuable contribution to the increase in sales, Pollmer goes on to say.

Germany at the previous year’s level

On the German market, the EOS Group recorded no changes compared to the previous year, with a 25.5 percent share in sales. The competitive situation is still challenging here. Restructuring measures, such as the newly established region of Central Europe, which Germany has been part of since the start of the 2024/25 financial year, “are beginning to bear fruit,” says Stephan Ohlmeyer, who has been responsible for the new region since March 2024.

Sustainability back in focus

The EOS Group also stood out in the previous financial year for reasons other than its strong business figures. The international group received an outstanding ESG risk rating in 2023. “According to renowned rating agency Morningstar Sustainalytics, EOS is one of the top 3 companies in our ‘Consumer Finance’ sector,” says Marwin Ramcke. “I’m very proud of this rating. Achieving a top position the very first try proves that our corporate responsibility strategy is a success.”

With its annual and sustainability report based on the standards of the Global Reporting Initiative (GRI), EOS makes clear what the Group is achieving in this area. For example, a gender pay gap analysis comparing the salaries of men and women was initiated for the first time. In addition, the company has also calculated its own CO2 footprint (Scope 1 & 2). “We will continue to advance these initiatives during this financial year and derive targeted measures from them, such as for reducing emissions,” Ramcke stresses.

Moreover, the corporate responsibility strategy is firmly anchored in the EOS Group’s core business as well. Responsible debt collection and sustainable debt relief for defaulting consumers are of central interest to EOS. For instance, the Group successfully concluded more than five million debt cases over the last financial year, helping defaulting consumers and returning around EUR 1.9 billion to the economic cycle.

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With more than 50 years of experience and offices in over 20 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of the Otto Group.

For more information on the EOS Group, please go to: https://eos-solutions.com/

Hamburg, Germany, July 26, 2023

- Significant increase in investment volume in Eastern and Western Europe

- Even stronger focus on international collaboration and digitalization

- Corporate Responsibility (CR): Combined Annual and Sustainability Report based on Global Reporting Initiative (GRI) standards for first time

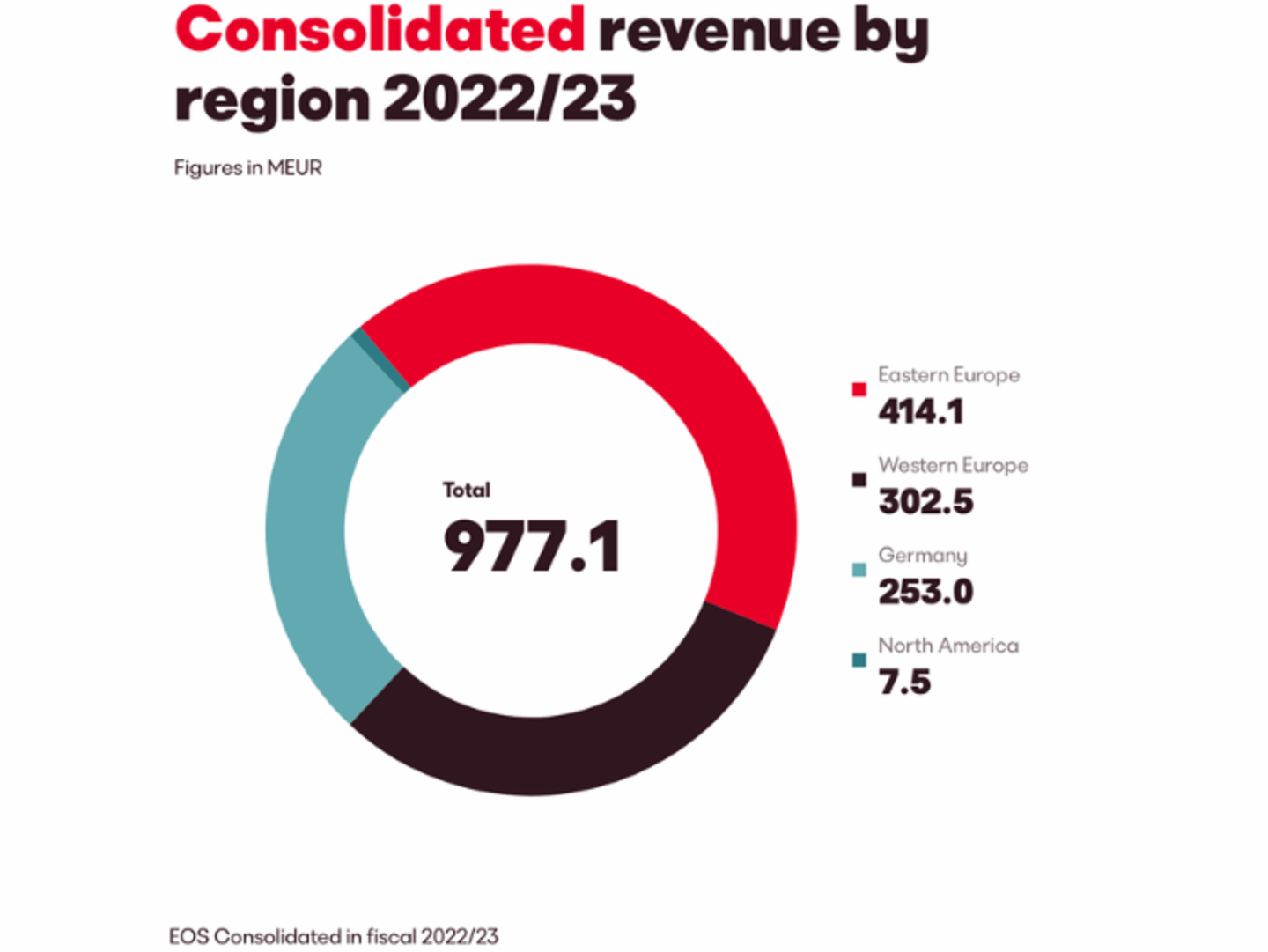

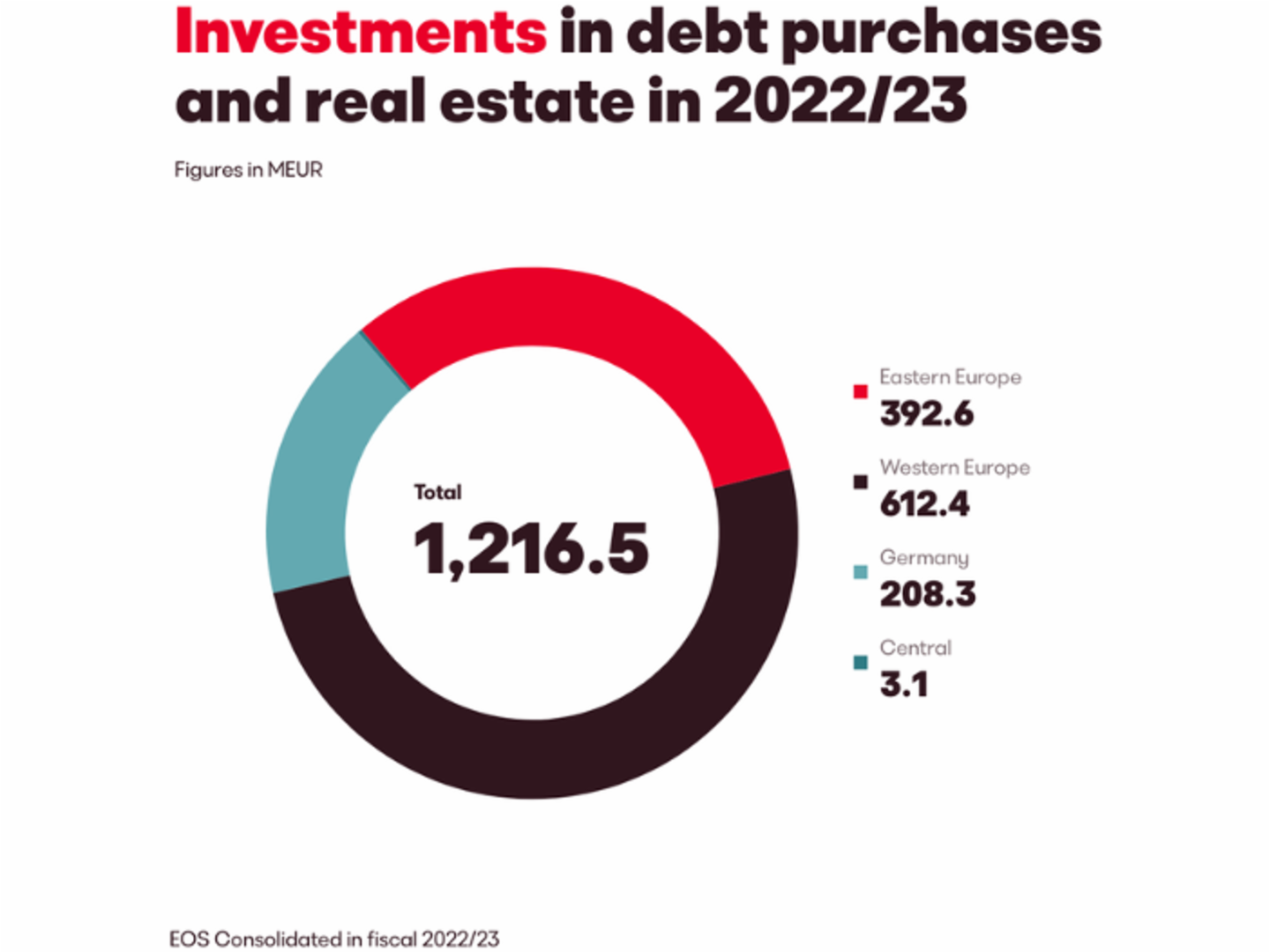

The EOS Group enjoyed strong growth in the 2022/23 financial year. Europe’s leading investor in non-performing loans, debt and real estate portfolios, and expert in the processing of outstanding receivables, achieved an EBITDA of EUR 445.9 million in fiscal 2022/23. A major factor in this success was the significant increase in investment volume of EUR 668.6 million (in the previous year) to EUR 1.2 billion, with EOS investing in both secured and unsecured receivables.

Outstanding operating performance

The expert processing of existing NPL portfolios (non-performing loans) from previous years also contributed to the increase in earnings and revenue in fiscal 2022/23. Marwin Ramcke, CEO of the EOS Group, had this to say: “Given the international political and macroeconomic situation at the beginning of the financial year, this kind of growth was not foreseeable. That we were able to achieve such a result in these turbulent times is due in particular to the dedication of our around 6,000 employees.”

The broad positioning of the EOS Group with 24 national subsidiaries in Europe has also had a positive impact on the overall result, says Justus Hecking-Veltman, CFO of the EOS Group. “Our diversification gives us enormous stability as a group of companies. We are not dependent on individual markets. Our longstanding expertise as a purchaser of NPL portfolios, but also our patience in certain markets, have paid dividends in this financial year,” says Hecking-Veltman.

Eastern Europe builds on previous year with high investment level

With a share of 42 percent, Eastern Europe is the strongest performing region within the EOS Consolidated. Compared with the previous year, the Eastern European subsidiaries were even able to increase their revenue by around 50 percent. “With an investment volume of around EUR 400 million, we were also able to build on our high figures from the year before,” says Carsten Tidow, the member of the Board responsible for Eastern Europe. This is exemplified not just by the renewed high investments in Greece, Poland and Croatia, but also by a small country like Bosnia and Herzegovina, where the secured NPL portfolio business was heavily expanded.

Western Europe quadruples investment volume

At EUR 612 million, the EOS Consolidated managed to more than quadruple its investment volume in Western Europe. This is attributable above all to the markets in France and Spain, says Dr. Andreas Witzig, member of the Board with responsibility for Western Europe. In this conjunction, Portugal is also of particular note: “Although our company there was only founded in 2022, today more than 20 colleagues are active in the Portuguese NPL market and have been able to complete their first NPL purchases.” The implementation of Kollecto+, the Group’s own debt collection software, which is already in use in eight EOS countries and creates relevant synergies, also contributed to the company’s good start.

High competitive pressures in Germany

In the German market, the EOS Consolidated recorded a decline in revenue. The main reason for this was the intense competition, says Andreas Kropp, Managing Director EOS Germany. “The German NPL market is the most established of all NPL markets we operate in as a Group. There are a lot of competitors on the market that ensure a high price level for the debt portfolios. Being connected to our own debt collection system Kollecto+ is an important step for us, allowing us to become more efficient and improve our competitiveness,” Kropp continues.

“Debt collection means taking responsibility”

For the first time, the EOS Group has published a combined annual report and sustainability report. It is based on the standards of the Global Reporting Initiative (GRI) and shows how EOS supports the UN’s sustainability goals.

“We have always said that debt collection means taking responsibility, so corporate responsibility has therefore long since been a major issue for us,” stresses CEO Marwin Ramcke. “We strive to become a little better every day. In this context, the GRI standards help us to make transparent how sustainable our actions are and what we are achieving in this area.” According to Andreas Kropp, this is not just a matter of traditional environmental issues. The fair treatment of defaulting consumers also plays a major role. “We want to help them become debt-free as quickly as possible. To this end we offer various services that allow people to pay anonymously at any time. In our German service portal, consumers can also set their own installment rates.”

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With around 50 years of experience and offices in 24 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on the EOS Group, please go to: eos-solutions.com

Hamburg, Germany, March 15, 2023

- Inflation and energy costs the main drivers for new debt

- Consumers cutting back primarily on travel, restaurant visits and new clothing

- Majority of Europeans worried about their financial future

For the majority of Europeans (53 percent), soaring inflation rates and the energy crisis are resulting in greater price consciousness. At the same time, around a fifth of respondents took on new debt in the last six months. These were some of the insights from the recent representative survey “Europeans in financial trouble? EOS Consumer Study 2023”, which polled 7,700 consumers in 13 European countries.

On average, consumers in eastern Europe are affected by new debt to a greater extent

Especially in eastern European countries like Romania (67 percent), Hungary (66 percent) and the Czech Republic (63 percent), consumers have been watching their expenditure closely in the last six months. Looking at the whole of Europe, the respondents stated that they were cutting back in particular on travel and cultural and leisure activities (33 percent each), but also on new clothing (28 percent). At the same, around one in five took on new debt in the last six months. The main reasons cited for this were inflation (49 percent) and higher energy costs (27 percent).

In eastern European countries like Romania and Hungary (30 percent each), North Macedonia (29 percent) and Serbia (28 percent), consumers took on new debt more frequently than the European average. Western Europeans were more likely (18 percent) to use the new debt to pay for travel, in contrast to Eastern Europeans, who took on debt primarily for heating and electricity (28 percent).

“Not only in times of crisis are debts unpleasant for people, they express a liquidity shortage, in this case an existential one when it comes to heating and electricity. This makes it even more important to approach these people with empathy and respect, to listen to them and to work out customized solutions, for example in joint agreements for installments, or even about their preferences for when and how they want to be contacted”, says Bartosz Jurczyk, Operations and Strategy Division Director at EOS Poland. The goal of EOS is always to help people find a solution that suits them personally and works quickly to reduce their debts, Jurczyk continues.

When looking for tailored solutions for defaulting consumers, analytical data and decision-making models are used to determine exactly which communication channels and payment methods individual consumers prefer. “This means that collection activities are already customized to each person from within the system”, explains Mirjana Ćevriz, business analyst and application support expert at EOS Serbia.

Inflation the greatest concern about the future

High inflation and skyrocketing energy costs are causing anxiety about their financial future among around three-quarters of the consumers surveyed (73 percent). Worries about unemployment are affecting 18-34-year-olds in particular. “In the study, we see that inflation is leaving its mark on consumers,” says Marwin Ramcke, CEO of the EOS Group. “Especially in times of crisis, debts are often unavoidable when it comes to overcoming cash flow problems and even salvaging livelihoods. As one of the leading debt collection companies in Europe, it is important to us to support consumers fairly in repaying their debts.” This helps them personally, but also helps the economy into which the money is returned, Ramcke continues.

Cash especially popular

Apart from the more responsible attitude to dealing with higher prices, the survey also reveals changes in the use of payment methods. 42 percent of respondents stated that in the last six months they had used cash more frequently than before. In the case of 18-34-year-olds, of whom around half were using cash more often, this result is particularly surprising. At the same time, however, the survey also indicated that people in this age group use a wider range of payment methods.

About the EOS survey “Europeans in financial trouble? EOS Consumer Study”

In partnership with Dynata, a specialist in online surveys, EOS conducted an online poll of 7,700 consumers in 13 European countries between February 3–9, 2023. The survey focused on the question of how the last six months had affected the consumption patterns and financial situation of the participants.

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 45 years of experience, EOS offers some 20,000 customers in 24 countries around the world smart services for all their receivables management needs. Its key target sectors are banking, real estate, telecommunications, utilities and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on EOS Group, please go to: www.eos-solutions.com

Kloten, October 5, 2022

- Almost every 4th company expects payment behavior to deteriorate

- In Western Europe, every 5th invoice is paid late, in Eastern Europe even every 4th invoice is paid late

Payment practices in Europe have deteriorated over the last three years. For around one in five companies, this development has led to existential fears. These are the findings of the 13th representative EOS study 'European Payment Practices', for which 3,200 companies in 16 European countries were surveyed.

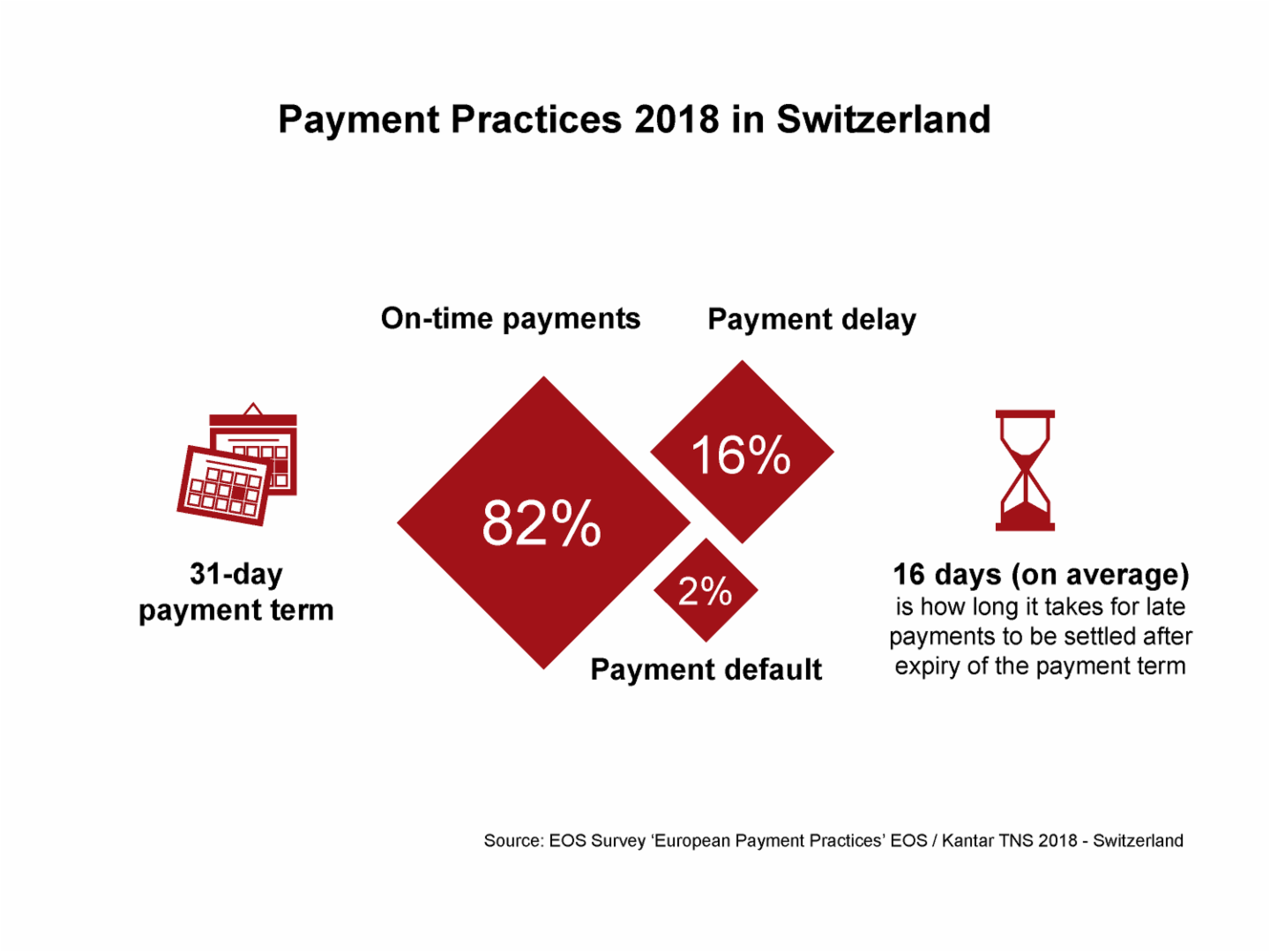

Despite extended payment periods by companies, private customers in particular paid their invoices 19 days late on average. Compared to the previous study from 2019, where 16% of invoices from private customers were paid late or not at all, the figure in the current study is already 20%. The companies surveyed cited their customers' liquidity bottlenecks as the main reason for poor payment behavior.

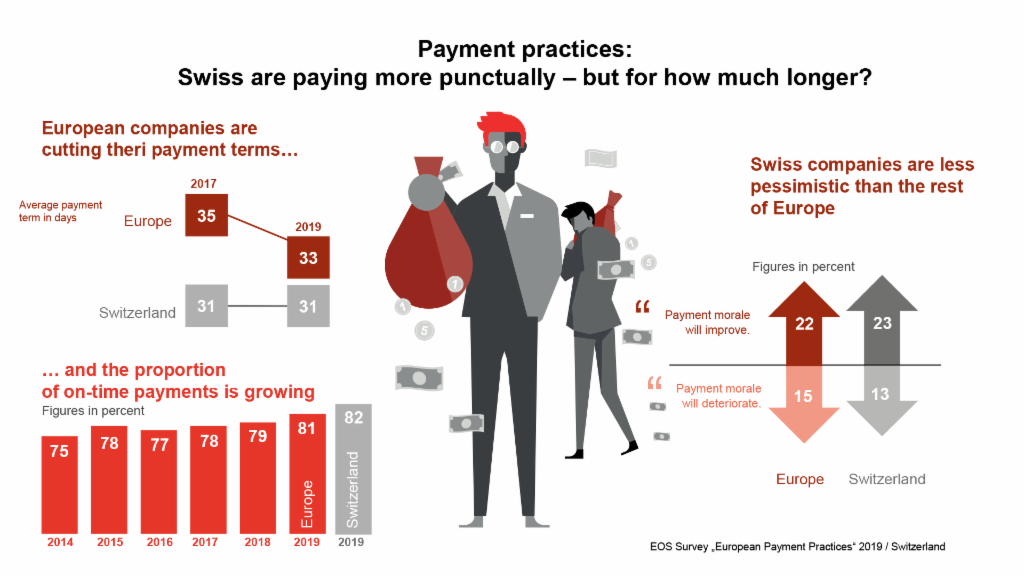

As a result of these payment delays and bottlenecks, companies stated that they were most frequently struggling with liquidity bottlenecks (42%) and profit losses (51%). To compensate, almost a third of companies had to reduce their investments and increase prices. Companies are correspondingly pessimistic about the future. While 22% of respondents still expected payment practices to improve in 2019, almost 24% of respondents currently anticipate a further deterioration. In Denmark, Switzerland, Slovakia, the Czech Republic, Slovenia and Bulgaria in particular, the forecasts are particularly subdued compared to 2019. "The fact that payment behavior has deteriorated significantly is worrying - especially because we have to expect a further decline in payment levels in view of the current economic figures and high inflation," says Marwin Ramcke, CEO of the EOS Group.

Professionalization in receivables management

More and more companies are working with external receivables management service providers to recover receivables. "A lack of liquidity is one of the most common causes of insolvencies and job losses." European companies should therefore further professionalize their receivables management and consider working with external partners, recommends Ramcke.

Eastern Europe in particular is leading the way in the professionalization of receivables management. Around half of the companies here already rely on the support of external specialists. 'Particularly in view of difficult economic figures, debt collection companies are an important support for companies and the economic cycle because they restore liquidity,' emphasizes Christina Schulz, responsible for Eastern Europe Division Management at EOS.

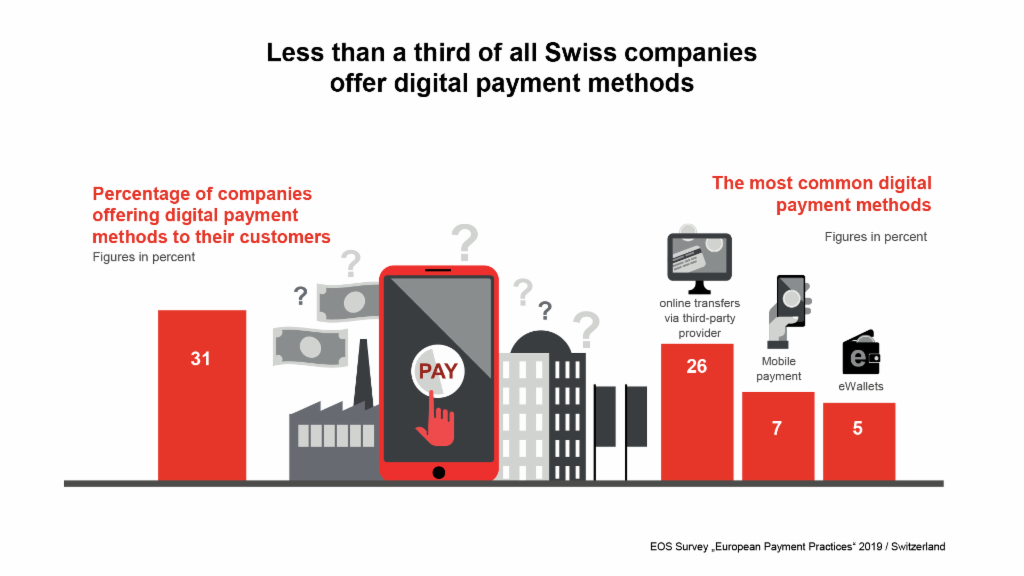

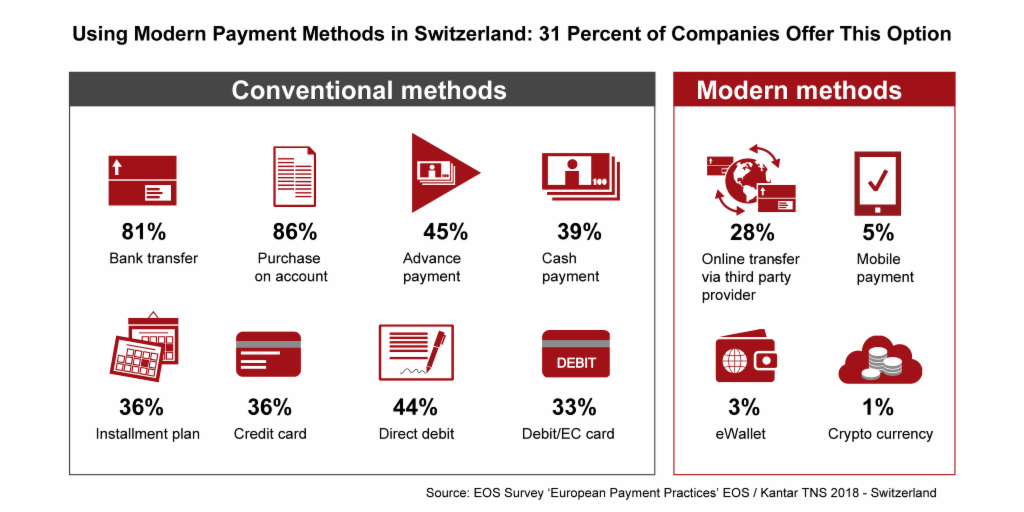

Extension of digital payment methods

At the same time, the expansion of digital payment methods is becoming increasingly relevant for companies. This has increased significantly in both Western and Eastern Europe since 2019. With an increase of 20 percentage points, Eastern European companies have almost doubled their range of digital payment methods. The Buy Now, Pay Later (BNPL) payment method is also coming into focus: four out of ten European companies see this payment method as a new credit card and a must in their payment offering.

About the EOS study "European payment practices"

Together with the independent market research institute Kantar, EOS surveyed 3,200 companies in 16 European countries between March 4 and April 19, 2022 via telephone interviews on local payment habits. In spring 2022, 200 companies (each with an annual turnover of more than five million euros) from Belgium, Bulgaria, Croatia, the Czech Republic, Denmark, France, Germany, Greece, Hungary, Poland, Romania, Slovakia, Slovenia, Spain, Switzerland and the UK answered questions about their own payment experiences and current issues in risk and receivables management. The study was conducted by EOS for the 13th time.

About the EOS Group

The EOS Group is a leading technology-based investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 45 years of experience and locations in 25 countries, EOS offers smart receivables management services to around 20,000 customers worldwide. The focus is on banks and companies in the real estate, telecommunications, energy supply and e-commerce sectors. EOS employs more than 6,000 people and is part of the Otto Group.

Further information on the EOS Group: eos-solutions.com

- Major progress in move to become a fully digitalized Group

- Record-breaking year for receivables purchasing with total €669 million invested in NPLs and real estate

Hamburg / Kloten, July 20, 2022 – The EOS Group, an international investor in receivables portfolios and technology-driven debt collection service provider with headquarters in Hamburg, had a positive, stable performance even in what was a turbulent 2021/22 financial year. Despite the pandemic and an increasingly aggressive market environment, the consolidated revenue of the Group could be increased by 1.6 percent. Total earnings before interest, taxes, depreciation and amortization (EBITDA) were €282.5 million, representing a slight decline compared with the previous year (€312.4 million). This was due primarily to the war in Ukraine and the precautionary accounting measures taken by EOS in this context. Nevertheless, the verdict on the entire financial year is a positive one, because all 24 countries where EOS operates once again recorded a strong operating performance.

“We owe last year’s success primarily to our more than 6,000 employees. Every single day, and in what are volatile times, they make EOS a more dynamic and digital place,” says Marwin Ramcke, CEO of the EOS Group. “The last financial year was characterized above all by three factors: Firstly, we were able to build on our core areas of expertise in the purchase and processing of non-performing receivables while reinforcing our status as experts in this field. This was complemented by the outstanding international and cross-border cooperation between our companies in 24 countries. And lastly, increasing automation allowed us to constantly improve our business processes. In what was a challenging year, these are achievements that we as a team can be very proud of,” Ramcke continues.

EOS reinforces leading position and pushes ahead with digital transformation

Over the years, the EOS Group has earned a very good reputation as an international provider of debt collection services and as an investor in receivables packages (NPLs). Backed by the financial strength of the Otto Group, EOS was able to once again make significant investments on the NPL market. The distinct focus on process automation and the use of data-driven collection software also allowed receivables to be processed more successfully and efficiently.

“We have made promising progress towards creating a shared analytical data repository that will deliver clear benefits for managing the receivables processing in future. The associated investment was and continues to be a major step to becoming a fully digitalized group of companies,” says Justus Hecking-Veltman, CFO of the EOS Group. The development and use of chatbots in communications with consumers, or the 27/4 service portals already implemented in several countries, are further examples of the digital transformation at EOS.

With its long-standing expertise as a debt collection company and its focus on digitalization and international networking, EOS was able to reinforce and build on its leading position in receivables management in numerous markets in fiscal 2021/22. It was a record-breaking financial year for EOS especially in the field of receivables purchasing, with the Group investing a total €669 million in NPLs and real estate during this period. Thanks to this result, the volume of the previous financial year was significantly exceeded.

EOS implements its ambitious sustainability concept

With its corporate responsibility (CR) strategy launched at the start of the last financial year, EOS is approaching its own commitment to sustainability in a structured manner and with ambitious goals. Joining the UN Global Compact emphatically underscores the company’s endeavors in this area. In the meanwhile, more than 16,000 companies from over 160 countries are participating in the UN initiative to make the world a fairer and more sustainable place. The numerous CR activities undertaken by EOS go far beyond environmental protection, and the company’s social and corporate engagement is already delivering its first results: As a recipient of the Top Women Leaders Award and a gold medal from prestigious rating agency EcoVadis, the EOS Group already won two accolades for its efforts in the field of CR in the last financial year.

The company also intends to build on its existing sustainability initiatives in the year ahead. “We take responsibility, not just for our own workforce and customers, but for consumers and the entire debt collection sector as well. Or to put it in a nutshell: changing for the better,” says Ramcke “Personally, I would like to drive the issue of diversity in particular. This is one of the greatest strengths of our international Group. Last year, for example, some of our committed employees established the LGBTQ+ community Queer@EOS and the women’s network W:isible.”

Western Europe: Substantial increase in revenue and continuous growth

In Western Europe, the national subsidiaries reported a growth rate of 9 percent. In particular, France, Spain and Denmark enjoyed a significant growth in earnings. There was significant backlog in the NPL segment, attributable to the waning of the pandemic. Because in many countries in Western Europe the courts and debt enforcement offices had been shut for a long time due to the pandemic, the widest possible return to regular operations greatly simplified the processing of NPL portfolios acquired in the previous years, and substantially increased operating performance in countries like France and Belgium. “In addition, we invested €144.5 million in receivables packages and real estate in Western Europe. The EOS national subsidiary in Spain also successfully acquired its first secured NPL portfolio. This is an important step for the region,” says Dr. Andreas Witzig, member of the EOS Group’s Board of Directors with responsibility for Western Europe. “We are going to continue to develop our position on the NPL market and become even more active, especially when it comes to secured receivables,” stresses Witzig.

Go to our ePaper for the online version of th Annual Report for more detailed information on fiscal 2021/22 and to download our Annual Report.

About EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 45 years of experience and branches in 24 countries (as at fiscal 2021/22), EOS offers its some 20,000 customers worldwide smart services for all their receivables management needs. Its key target sectors are banking, real estate, telecommunications, insurance, mobility, utilities and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on EOS, please go to: eos-schweiz.com

Kloten, 5. Juli 2022 – Der Verwaltungsrat des Finanzdienstleistungsunternehmens EOS Schweiz AG hat Andreas Hasler per 1. Juli 2022 zum neuen CEO ernannt. Er folgt auf Alex Schneider, der sich nach sieben Jahren an der Spitze von EOS Schweiz einer neuen Herausforderung stellen wird.

Leader-Persönlichkeit mit langjähriger Finance-Erfahrung

Andreas Hasler verfügt über eine reiche, internationale Führungserfahrung genauso wie über profunde Kenntnisse in den Bereichen Finance, Risiko Management, Sales & Marketing sowie Compliance und Financial Reporting. Der 48jährige Schweizer war rund 15 Jahre lang in verschiedenen Funktionen in Finanzunternehmen der Ford-Gruppe tätig, zuletzt als CEO der Ford Bank Austria in Salzburg.

Bei EOS Schweiz wird Hasler verstärkt die Innovation und Digitalisierung, inklusive dem Einsatz von auf künstlicher Intelligenz basierten Inkassoprozesse, vorantreiben.

Sieben erfolgreiche Jahre

Nach 14 Jahren bei EOS Schweiz / Alphapay, davon zuletzt 7 Jahre als CEO, wird Alex Schneider EOS verlassen, um künftig eine neue Herausforderung wahrzunehmen. Der Verwaltungsratspräsident Andreas Witzig: «Ich danke Alex Schneider für seinen langjährigen Einsatz für EOS, insbesondere in den letzten 7 Jahres als CEO. Ich wünsche ihm viel Erfolg bei seinen neuen Aufgaben.»

Über EOS Schweiz

EOS Schweiz zählt zu den führenden Schweizer Dienstleistern im Forderungsmanagement und ist Experte bei der Bearbeitung offener Forderungen. EOS ist an 3 Standorten in der Romandie, der Deutschschweiz und im Tessin präsent und beschäftigt zurzeit rund 100 Mitarbeitende.

EOS Schweiz ist Teil der EOS Gruppe, die mit Standorten in 24 Ländern ihren rund 20.000 Kund*innen weltweit smarte Services rund ums Forderungsmanagement bietet. Im Fokus stehen Banken sowie Unternehmen aus den Bereichen Immobilien, Telekommunikation, Energieversorgung und E-Commerce. Die EOS Gruppe beschäftigt mehr als 6‘000 Mitarbeiter*innen und gehört zur Otto Group.

Weitere Informationen über EOS Schweiz: eos-schweiz.com

Weitere Informationen zur EOS Gruppe: eos-solutions.com

Hamburg, April 6, 2022 – Spring is a time of renewal, and EOS is no exception: The EOS Group has launched its new corporate identity. With a new logo and corporate design, the international financial services provider is presenting itself as a modern player on the European market for receivables management. “With the new brand we are reinforcing the commitment we already communicated last year with the introduction of our claim ‘Changing finances for the better’, says Marwin Ramcke, who became the new CEO of the EOS Group in February. “With more than 6,000 employees in 24 countries, we work hard every single day to change the financial situation of our customers, partners and defaulting payers for the better. With this in mind, we are investing heavily in digitalization and are making even greater use of AI-based collection processes and our international network.”

Modified design reflects how EOS has changed

The Group, which reported revenues of €792.5 million in fiscal 2020/21, aims to complete its worldwide brand rollout within the next 12 months. “I am delighted that the Board of Directors opted against an evolutionary development of the brand but instead took the plunge and embraced a disruptive design,” says Lara Flemming, Senior Vice President Corporate Communications & Marketing at EOS. “If we had merely tweaked the brand, we would not have done justice to the huge transformation that EOS has undergone in recent years. Now we can hardly wait to work with our international colleagues to make the new EOS brand visible at all touchpoints.”

The focus of the brand relaunch is on customers and potential employees. “With the new brand identity we want to convince even more companies that EOS is their best partner for the purchase and processing of outstanding receivables,” says Flemming. “To ensure that we live up to our commitment we are constantly looking for new talent throughout Europe that can help us move forward. Our people are our most important asset. We are therefore positioning ourselves to high potentials as a modern and attractive employer.” EOS received support with the brand relaunch from Hamburg-based Syndicate Design AG as lead design agency.

New logo stands for internationality, focus and dynamism

The new logo was released from the box that had framed the letters for years. “Nothing should stand in the way of our mindset and actions,” says Flemming. The lowercase ‘e’ in the new EOS logo embodies our internationality and ongoing digitalization. “In English, the ultimate global language, most words are written in lower case,” explains Flemming. “In addition, the lowercase ‘e’ is also familiar from business terms like e-commerce, where it stands for electronic, or digital processes. We felt that it was very fitting to write our company name in lowercase letters in the logo in future.” The large ‘O’ in the center of the logo symbolizes EOS’ focus and strong purpose. The unfinished ‘s’ at the end gives the logo momentum. It reflects the thirst for change of a company that has constantly reinvented itself since it was established in 1974. “Today, the world is changing faster than ever. And we are actively shaping this change. The ‘s’ in the logo says that our development will never be finished and we will always strive to adapt to circumstances,” says CEO Ramcke. “With the new brand, we are emphasizing that we want to continue to set standards, in the entire European financial sector, over and beyond the debt collection segment.”

About EOS Group

The EOS Group is a leading technology-driven investor and service provider in the receivables management industry. With over 45 years of experience, EOS offers some 20,000 customers in 24 countries around the world smart services for all their receivables management needs. Its key target sectors are banking, real estate, telecommunications, utilities and e-commerce. EOS employs more than 6,000 people and is part of the Otto Group.

For more information on EOS Group, please go to: eos-solutions.com

- Two out of three European companies in the B2C segment use chatbots in their communication with customers

- Almost one in two customer inquiries are already being resolved completely by the bot

- The pressure is mounting: 61 percent are convinced that in the long term, every large company will need to offer a chatbot

Hamburg / Kloten, November 15, 2021 – During the pandemic, enabling fast and direct contact to customer service was a challenge due to short-time working or lack of human resources. As a result, chatbots gained in importance yet again, as a recent survey in 14 European countries by financial services provider and investor EOS shows. According to the survey, chatbots are already being used in two out of three companies in the B2C segment. The survey also revealed that chatbots account for 30 percent of digital communication with customers, and that almost every second inquiry addressed to a chatbot is fully resolved by it. EOS is also using these digital helpers. Chatbots are already in use and communicating with defaulting payers at the company’s national subsidiaries in Croatia, France and Belgium.

“Since the rollout of our chatbot Tom, the number of calls to the service center has gone down,” says Wesley van de Walle, project manager at EOS Contentia in Belgium. “On average, Tom has more than 300 conversations a month with defaulting payers on simple matters. Since its last software update, the bot has also been connected directly to our debt collection system and can now process personal data. Following an authentication process, users can request information on their level of debt, due date of the next payment, or costs incurred. It offers genuine added value,” says van de Walle.

Chatbots especially popular in Poland and Switzerland

The survey found differences among European countries in the use of the technology: Whereas in Poland and Switzerland chatbots are highly popular, with usage rates of more than 70 percent, companies in France (54 percent) and Russia (46 percent) are still somewhat more reticent when it comes to chatbots. At present, the digital helpers are being used mainly for the initial contact (97 percent), followed by customer service (51 percent) and product advice (39 percent).

What challenges are still holding chatbots back

The companies polled identified data privacy constraints (70 percent), followed by the necessary revision of their data structures (59 percent), as the greatest impediments to the use of chatbots. Investment costs, on the other hand, were rarely an obstacle: Only 27 percent of the companies regarded the costs of introducing a chatbot as ‘high’, and only three percent decided not to use the technology for cost reasons.

“It goes without saying that EOS meets the stringent data privacy requirements. In our line of work with sensitive data, the challenge is rather to do with finding a balance between ease of use and the necessary security,” says Franjo Glibo, bot manager and Head of the IT Department at EOS in Croatia. “Companies should communicate openly and show what consumers can gain from disclosing their details. At EOS, for example, the data can be used to provide the best possible, individualized receivables management, with benefits for the defaulting payers as well.”

Increasingly smart chatbots: a technology with a future

The EOS Chatbot Survey 2021 found that at present, companies are mainly using bots with mid-range intelligence (57 percent) to preselect topics and handle sub-tasks. And it’s not just EOS experts who think that this intelligence level needs to continue to improve in the next few years; 88 percent of survey respondents are planning to further develop their company’s bots. Respondents from all countries agree that the importance of chatbots, and their acceptance by customers, will continue to increase in the next two years. 61 percent of respondents are also convinced that in the medium term, every large company should be offering a chatbot.

About the representative EOS Chatbot Survey 2021

The representative EOS Survey was conducted in 14 European countries in the period April to June 2021. It used phone interviews to survey 200 B2C companies in each country. A total of 2,800 decision-makers from Germany, Denmark, Belgium, Switzerland, Spain, France, Poland, Slovakia, Slovenia, Croatia, Hungary, Bulgaria, Romania and Russia answered questions e.g. on the use of chatbots, their acceptance by users, and the potential opportunities for the future.

About EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 45 years of experience and branches in 24 countries (as at fiscal 2021/22), EOS offers its some 20,000 customers worldwide smart services for all their receivables management needs. Its key target sectors are banking, real estate, telecommunications, insurance, mobility, utilities and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on EOS, please go to: eos-schweiz.com

Contact for press and media:

Basil Schneuwly, Manager Marketing & Communication

E-Mail: [email protected]

Tel.: +41 58 411 73 03

- Great opportunity for companies: More than a third of consumers in favor of “compensation for data”

- Majority willing to sell at least one item of personal information to a trustworthy company

- Willingness to disclose data even exceeds demand in some cases

Kloten, October 8, 2020 – In today's digital environment, data like bank account number, date of birth, address, health details or purchasing preferences have become a key economic asset. This is why the handling of data and its value, and the reasons why companies are keen to make use of it, are increasingly a topic of public debate. This has also been validated by a recent representative survey entitled “What’s the value of data?” conducted in 17 countries by financial services provider and investor EOS. The survey revealed that more than 60 percent of consumers in Europe and the USA and as many as 70 percent in Russia believe that companies should compensate customers for the use of their data. More than a third of respondents, and in Russia as many as half, said they were willing to provide certain data in return for compensation.

Trust and financial rewards the drivers for increased disclosure of data

For people to be prepared to disclose personal data, it is crucial for them to trust a company or organization to handle their data responsibly and adhere to the relevant statutory regulations. The EOS survey showed that a clear majority of consumers would sell at least one item of personal data for money to a trustworthy company (Europe: 82 percent, USA: 75 percent, Russia: 90 percent). People are least concerned about disclosing purchasing decisions and preferences for products and brands, but consider account or credit card details, or insights into their bank account, to be especially worthy of protection. When asked about their specific compensation preferences, more than half of the respondents found material rewards and discounts particularly attractive, whereas in all regions there was less demand for services as compensation, with only around 20% in favor of this option.

Data analysis as the basis for modern receivables management

A look at receivables management shows that it is worthwhile for companies to provide incentives to consumers to disclose their data. Because the better the data available about the purchaser of a product or service, the quicker they can be reached in the event of a payment default. And, the more empirical data from similar receivables cases is already available, the better the proposed installment plan will match the customer’s financial situation and the more likely the customer will comply with it as a result. This is why its Center of Analytics plays a key role at receivables management service provider EOS. With the help of machine learning algorithms, its central platform analyses thousands of debt collection cases to determine the best processing steps to be taken next.

Willingness to disclose data even exceeds demand in some cases

The EOS survey revealed that one in five consumers had already been offered compensation to disclose certain details. In Europe this was most common in Spain and Romania, where as many as one in four consumers had received such an offer. In some cases, however, the willingness of consumers to disclose data actually exceeds the number of offers of compensation by companies. “I think there are still significant opportunities and unexploited potential here,” stresses Joachim Göller.

“Already, installment plans are produced on the basis of intelligent data analysis in a lot of the countries where EOS operates,” explains Joachim Göller, Head of the Center of Analytics. “It is in the interest of all parties to conclude a collection case as soon as possible to save costs on both sides. And this is where data can help. The sooner the contact is established and the better the chances of the payment agreement being met, the more likely it is for the creditor to get their money and the consumer to become debt-free. So it can absolutely be in the interests of the defaulting payer to disclose data.”

About the representative EOS survey “What's the value of data?” 2020

The EOS survey, which was conducted in partnership with market research institute Kantar in the spring of 2020, is representative of the (online) population over the age of 18 in the 17 countries polled. A random sample of 1,000 respondents from each of the countries Belgium, Bulgaria, Croatia, Czech Republic, France, Germany, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Switzerland, the UK and the USA, and 300 respondents from North Macedonia, was used for the analysis. The survey participants answered questions on their personal handling and disclosure of data, their trust in companies, and their willingness to sell data for compensation.

You can find more information on the survey here.

About EOS Group

The EOS Group is one of the leading technology-driven financial investors and an expert in the processing of outstanding receivables. The company's core business is the purchase of unsecured and secured debt portfolios. With over 40 years of experience, EOS offers some 20,000 customers in 26 countries around the world smart services for all their receivables management needs. Its key target sectors are banking, utilities, real estate and e-commerce. EOS employs more than 7,500 people and is part of the Otto Group.

Further information on the EOS Group: eos-solutions.com

- Only 31 percent of people in Switzerland trust companies to handle their digital data properly

- Banks and utility companies enjoy the greatest degree of trust, while telecommunications companies, online retailers, social networks and messaging services rank lower on the trust scale

Kloten, October 7, 2020 – The responsible handling of the valuable commodity “digital data” has become more important than ever. Because data like this helps companies to better understand their customers and their preferences and to respond to market trends. However, the willingness of consumers to disclose their data is crucially dependent on trust. In this respect, companies have not fared particularly well until now, with only 33 percent of Europeans trusting companies to handle their digital data, and 31 percent of the Swiss. US citizens are even more distrustful (23 percent), while Russians are somewhat less skeptical (41 percent). These are some of the findings from a recent representative survey entitled “What’s the value of data?” conducted by financial services provider and investor EOS in 17 countries. The reasons for this skepticism result in part from bad experiences with disclosing data. Every fourth or fifth consumer has at some point had a negative experience online in this regard.

Significant differences in level of trust depending on sector and type of data

There are clear differences between sectors: Banks and financial services providers enjoy the greatest level of trust for their handling of customer data (Europe: 54 percent, USA: 56 percent, Russia: 54 percent), although not unconditionally across all countries. Energy utilities and insurance companies also come off relatively well (average value across all countries 39 percent). However, there is a lack of trust when it comes to telecommunications companies (28 percent on average), online retailers (21 percent on average) and social networks and messaging services (14 percent on average). That people still provide their data to the latter (contact information, movement data, purchasing and surfing behavior) can be explained by the fact that users regard this data as less sensitive. Universally, financial details are regarded as being the most worthy of protection.

Data minimization and service quality create trust

Financial service providers in particular can therefore benefit from the higher level of trust they enjoy when it comes to the use of data. However, they need to create a balance between optimizing processes through as much data as possible and avoiding unnecessary requests for data. This is a challenge that EOS is facing as well. The debt collection service provider, which commissioned the survey, employs around 60 people worldwide in the data privacy and information security fields. “To build trust among our customers and consumers, we emphasize data minimization at EOS even when initially setting up projects. Instead of ‘collecting data for data's sake’, we pursue a data minimization approach and collect data only for specific purposes,” explains Stephan Bovermann, Senior Group Privacy Officer at EOS Group. He works with his colleagues to ensure data privacy in all 26 countries where EOS operates worldwide. From his perspective, however, handling data responsibly is just one way of establishing trust. “Naturally, high quality products and an excellent level of service are just as important for creating trust in a company as its careful handling of the data entrusted to it,” says Bovermann.

Data minimization through self-service digital portals

One example of the data minimization approach are the EOS service portals which defaulting payers can use to settle their outstanding debts. These portals only collect the data that is necessary for the payment process. This creates trust, says Esther van Oirsouw, Head of Portals & Integration at EOS Technology Solutions: “Our online portals allow defaulting payers simple and self-determined access to their outstanding debt. After entering the individual case number, they can complete payment with just a few clicks. And for the majority of payment methods offered, no personal data has to be provided. This makes the obstacles to payment extremely low, because we know from experience that the more self-determination and flexibility we create, the better the payment rate and the higher the trust in us.”

Action needed across all national borders

As the survey shows, gaining and building trust is still a major work in progress for many companies. In all countries, mistrust and skepticism on the part of consumers is on a similar scale. But one thing that is clear is that the digital environment is a leveler. If you want to be part of the digital universe you will meet the same global players and be subject to their rules in all countries. Many respondents felt that they often didn’t have a choice when it came to disclosing their data. Around two-thirds of Europeans (66 percent) and Americans (58 percent) and four out of five Russian consumers complain that they are not even able to use all the features of a lot of online services without disclosing their data. In addition, around 60 percent do not have enough information about how to prevent or limit the disclosure of their data.

About the representative EOS survey “What's the value of data?” 2020

The EOS survey, which was conducted in partnership with market research institute Kantar in the spring of 2020, is representative of the (online) population over the age of 18 in the 17 countries polled. A random sample of 1,000 respondents from each of the countries Belgium, Bulgaria, Croatia, Czech Republic, France, Germany, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Switzerland, the UK and the USA, and 300 respondents from North Macedonia, was used for the analysis. The survey participants answered questions on their personal handling and disclosure of data, their trust in companies and their willingness to sell data for compensation.

You can find more information on the survey here.

About EOS Group

The EOS Group is one of the leading technology-driven financial investors and an expert in the processing of outstanding receivables. The company's core business is the purchase of unsecured and secured debt portfolios. With over 40 years of experience, EOS offers some 20,000 customers in 26 countries around the world smart services for all their receivables management needs. Its key target sectors are banking, utilities, real estate and e-commerce. EOS employs more than 7,500 people and is part of the Otto Group.

Further information on the EOS Group: eos-solutions.com